Ranking & Whitepaper of Global 50 Human Resource Service Providers, the most authoritative and most influential list of ranking global human resource services providers published by HRoot, the largest human resource media, every year. This is the 9th release. Companies of Ranking & Whitepaper of Global 50 Human Resource Service Providers are from 12 countries in the world and six industries which include talent...

MethodologyEmbrace Technology, Keep up with the Tide

--An Evaluation of the Global Human Resource Service Market 2017-2018

2018—A year witnessing strengthening of the growth momentum

In 2017, the world economic growth was stronger than expected. In 2018, the world economy has embarked on a strengthening growth momentum, embracing an even brighter prospect. However, this does not mean that the world economy has been free of risks. The World Economy Situation and Prospects 2018 issued by the United Nations points out that economic improvement has been a universal phenomenon. In 2017, the world economic growth speed reached 3%, which had been the fastest since 2011. The economic growth speed of around two thirds of the countries in 2017 was faster than the year before. Benefiting from a strengthening growth momentum, the world economic growth expectation would stabilize at around 3% in 2018 and 2019. East Asia and North Asia are still the most economically vigorous areas in the world. Despite of improvements of short-term prospects, the world economy is still subject to risks caused by changes of trade policies, worsening of the world financial environment and increasing tenseness of the geopolitical pattern. Meanwhile, long-term challenges are also confronting the world economy. However, improvements of macroeconomic situations have provided opportunities for policy formulation to cope with these challenges.

According to the World Employment and Social Outlook—Trends 2018 released by the International Labor Organization (ILO), the world employment rate has been increasingly stabilized. However, in many parts of the world, unemployment and decent work deficits remain high in 2018. Besides, the unemployment rate in developed countries is expected to drop by another 0.2%. Robustness of the labor market in developed countries will be a main driving force for increase of the world employment rate from 2017 to 2018. In emerging economies and developing countries, growth of the job market might fail to catch up with growth of labor forces. However, the improvement is still encouraging if compared with that in 2016. In terms of employment, the report points out that the service sector will be a main propeller of the future employment rate growth.

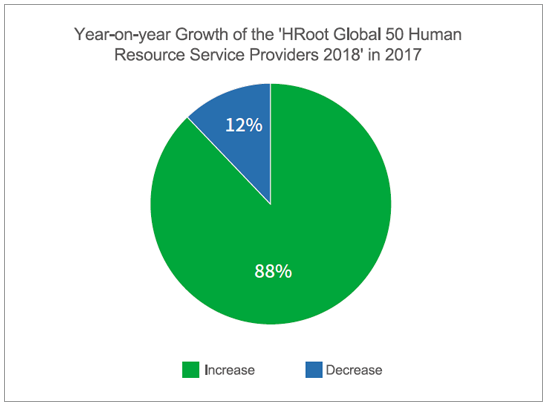

Impacted by the world economy and labor market, the world Human Resource service market will keep growing steadily. The trend is also demonstrated by the Global 50 Human Resource Service Providers Rankings and Whitepaper 2018 released by HRoot. The rankings are compiled based on enterprises’ revenue in the fiscal year of 2017. At the same time, the average annual exchange rate between RMB and USD is adopted to converted enterprises’ sales revenue presented in the local currency into USD to eliminate the influence of the annual interest rate fluctuations on rankings.

This year, the threshold for HRoot Global 50 Human Resource Service Providers 2018 is increased to 406 million USD from 352 million last year. Data show that the 2017 revenue of all enterprises listed on the rankings totals at 201.713 billion USD, registering a year-on-year increase of 197.317 billion USD or 2.2%. The top 5 in 2018 are the same to those in 2017, which are The Adecco Group, Randstad, Manpower Group, Recruit Holdings and ADP in turn. The revenue of the top 5 totals at 103.656 billion USD, which is 10.3% higher than the year before and accounts for 51.3% of the total on the rankings.

Compared with 2017, there are six enterprises whose revenue drops considerably. Enterprises whose revenue decreases by 100 million USD include Trueblue, Impellam Group and Volt. The revenue of Impellam Group ranking No. 13 is almost the same to the revenue in the fiscal year of 2016. As to the reason behind, drop of the average exchange rate between BRT and USD has resulted in the negative growth of its revenue.

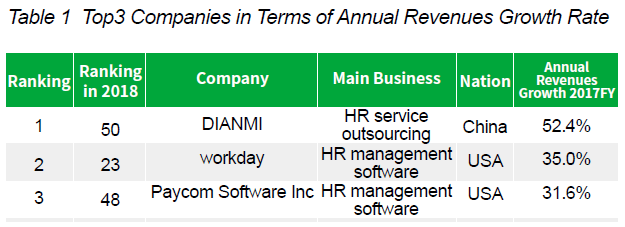

44 enterprises on HRoot Global 50 Human Resource Service Providers 2018 have achieved a positive year-by-year growth compared with the year before. In terms of the revenue growth rate, DIANMI (52.4%), Workday (35.0%) and Paycom Software Inc. (31.6%) rank in the top 3. Among the top 5 enterprises in terms of their revenue growth rate, there are three Human Resource management software companies, including Workday (35.0%), Paycom Software Inc. (31.6%), and TeamLease Services (25.5%). By industrial terms, the average growth of the human resource management software industry has also been the highest, reaching 22.5%.

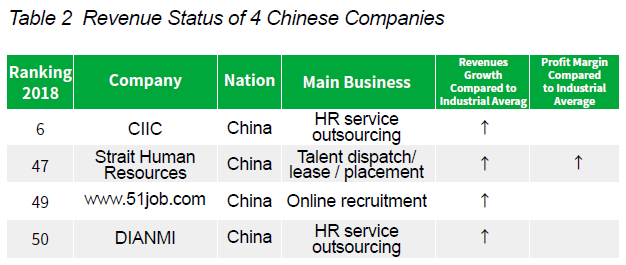

In the HRoot Global 50 Human Resource Service Providers 2018, there are four Chinese enterprises making into the list. Meanwhile, the four Chinese enterprises all maintain a two-digit revenue growth rate in the fiscal year 2017. Among them, CIIC is the only Chinese HR service company ranking in the top 10. Its performance in the fiscal year of 2017 is still impressive with its revenue reaching 11.256 billion USD and ranking No. 6. Compared with the fiscal year 2016, its ranking rises by one place; its revenue year-by-year growth rate reaches 15.6%. All these data suffice to show its robust growth momentum.

The revenue growth rate of Strait Human Resources in the fiscal year 2017 reached 14.5%. It outperforms the average industrial players in terms of talent dispatch/lease/placement service and Human Resource service outsourcing. As to the online recruitment industry, www.51job.com has experienced the fast growth of revenue, which remains first in the industry. In terms of the Human Resource service outsourcing industry, DIANMI’s revenue growth rate reaches 52.4%, which is far ahead of the industrial average.

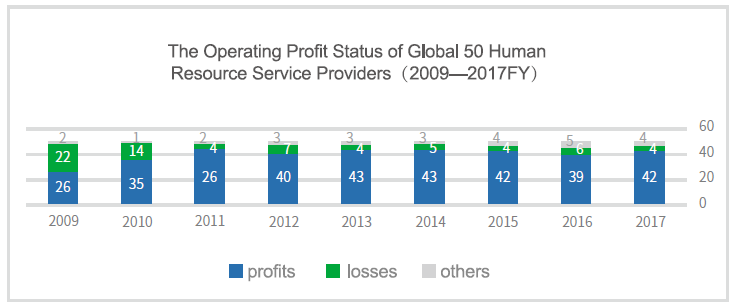

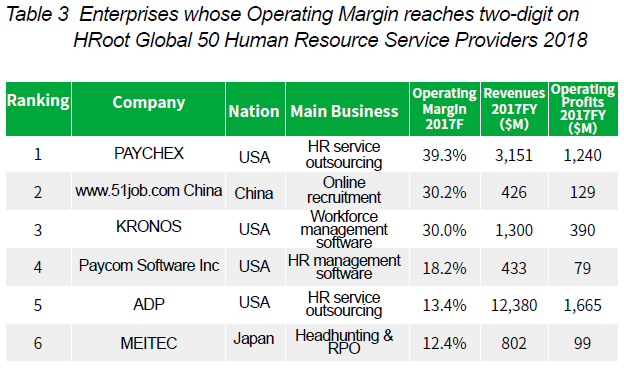

In terms of the operating profit indexes, more than 80% of the enterprises in the list have realized profit-making over the past nine years. In the list of HRoot Global 50 Human Resource Service Providers 2018, 42 companies have maintained profit-making, which are more than those of the year before by three.

Where, the operating profit ratio of six enterprises in the list have been two-digit. There are three enterprises whose operating profit ratio is higher than 30%. Paychex, a Human Resource service outsourcing institution headquartered in the US, ranked on the top with its operating profit ratio staying at 39.3%. www.51job.com, whose profit ratio is 30.2%, is right behind.

HR service industry segmentation: Each has its advantages.

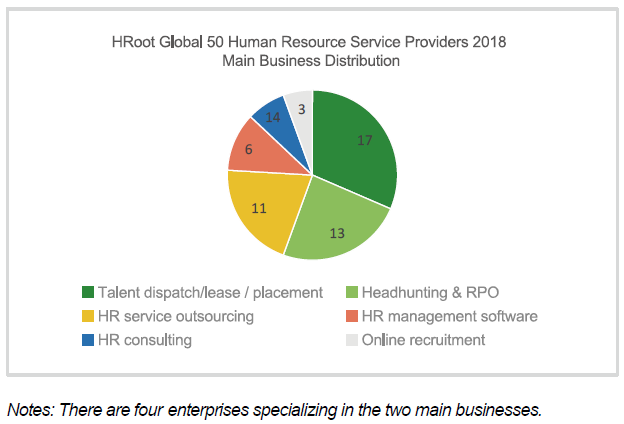

HRoot Global 50 Human Resource Service Providers 2018 involves six main businesses/segments, including talent dispatch/lease/placement service, headhunting service and recruitment procedure outsourcing, Human Resource service outsourcing, Human Resource management software, Human Resource consulting and online recruitment. Among them, the number of enterprises adopting talent dispatch/lease/placement service, headhunting service and recruitment procedure outsourcing as the main business is the highest, which is around 30.

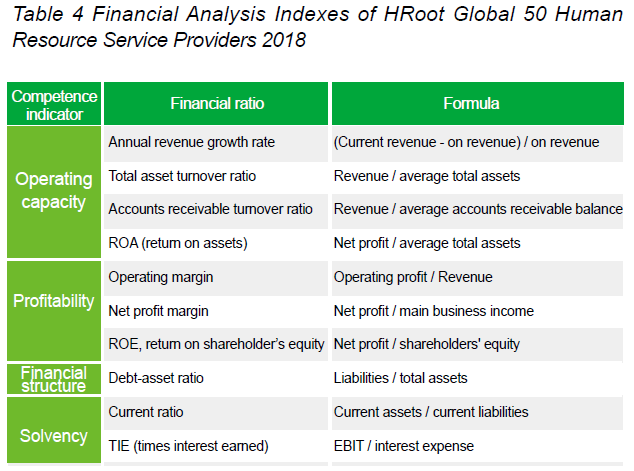

According to the concept of DonPont Analysis, several ratios used to rate the corporate operation efficiency and financial status are organically combined based on their internal correlations to form a complex index system. In this paper, ten indexes of four dimensions are compared to deeply examine the operation status of various Human Resource service institutions.

The annual revenue growth rate, the total asset turnover ratio, accounts receivable turnover ratio and ROA (or return on assets) are often used to illustrate the operating capacity of enterprises. To be specific, the annual revenue growth rate show how fast the revenue is changing.The total asset turnover ratio measures the ability of a company to use its assets to efficiently generate sales.The accounts receivable turnover ratio refers to the number of times that accounts receivable amount is collected throughout the year. For example, the total asset turnover ratio and the accounts receivable turnover ratio of Strait Human Resources is 15.9 and 216.8 respectively, which demonstrated its strong operational capabilities and ability to resist risks.

In addition, the operating margin, net profit margin and ROE (return on shareholder’s equity) mainly show the profitability. Specifically, ROE (return on shareholder's equity) is the amount of net income returned as a percentage of shareholders equity, which is also one of the key indexes of DuPont Analysis. According to HRoot Global 50 Human Resource Service Providers 2018, the profitability of PAYCHEX, www.51job.com, KRONOS and seek is very strong.

Meanwhile,the current ratio and TIE (times interest earned) could show the corporate solvency. Usually, The higher the TIE, the more ability the company has to pay its long-term debts. In this year’s ranking, the corporate solvency of randstad, TechnoPro Holdings, Recruit Holdings , Persol, and CIIC is considerably strong.

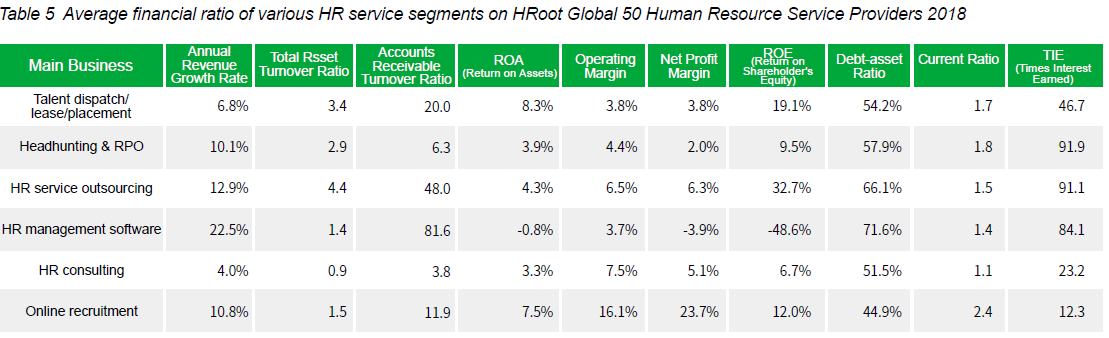

In HRoot Global 50 Human Resource Service Providers 2018, the concept of industrial average value has been introduced as the baseline providing benchmark for different industries in Human Resource services. In this whitepaper, the industrial average value refer to various average financial ratios of the 50 HR service enterprises in terms of talent dispatch/lease / placement, Headhunting & RPO, HR service outsourcing, HR management software, HR consulting, and Online recruitment.

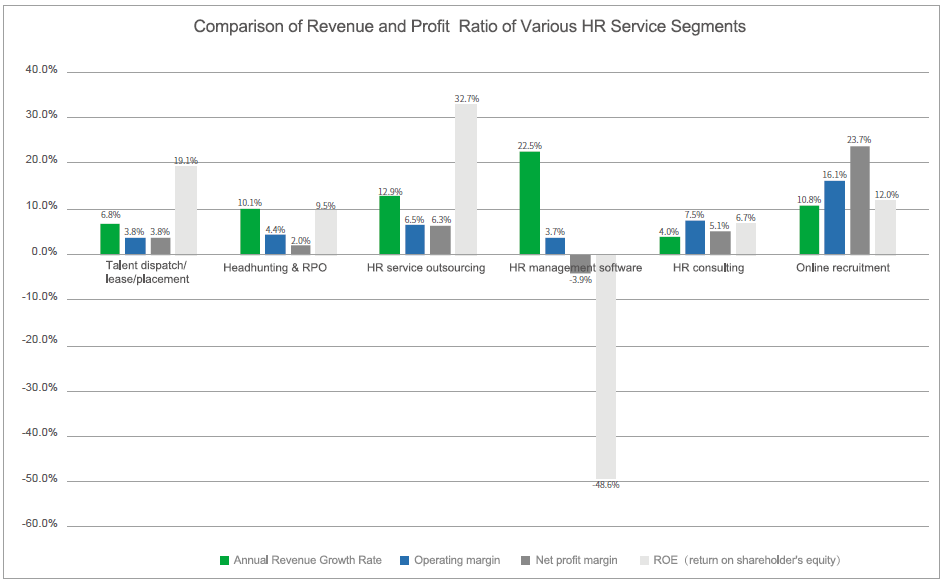

Seem from the industrial average, the return on equity of the Human Resource service outsourcing industry is the highest (32.7%), and its annual income growth rate ranks No. 2 among six industries. The annual income growth rate of the Human Resource management software industry, which is 22.5%, overtakes that of the rest. However, its return on equity (-48.6%) is at the bottom. The number of HR service providers from the online recruitment industry entering the list is the lowest, but the average industrial value of the operating profit ratio is the highest, which is around 23.7% and far ahead that of other segments.

Considering the accounts receivable turnover of different segments, the Human Resource management software segment and the Human Resource service outsourcing segment are way ahead with their value staying at 81.6 and 48.0, respectively. On the contrary, the Human Resource service outsourcing and the talent dispatch/lease/placement service segment come out top in terms of their total assets turnover.

Talent dispatch/lease/placement service: A larger number of enterprises

On HRoot Global 50 Human Resource Service Providers 2018, there are 17 enterprises specializing in talent dispatch/lease/placement service. Their total revenue reaches around 99.578 billion USD, accounting for 49.4% or nearly half of the total in the list. Regarding the average industrial financial ratio, the highest net profit margin of the revenue is found in the talent dispatch/lease/placement service segment, which is as high as 8.3%. Its return on equity and total assets turnover both rank No. 2. This suggests a strong operating ability and profitability of the talent dispatch/lease/placement service segment.

Headhunting & RPO: Diverse development

Among HRoot Global 50 Human Resource Service Providers 2018, there are 13 headhunting service and recruiting procedure outsourcing service providers, and their revenue is around 38.3 billion USD and their operating profits are around 2.118 billion USD. In 2017, the industrial annual average operating profit rate is 4.4%.

In the headhunting and recruitment procedure outsourcing industry, Korn Ferry, Synergie and Recruit Holdings rank on the top 3 in terms of their revenue growth rate. Their revenue growth rate is 20.4%, 18.9% and 18.5%, respectively. Of special note is that the revenue growth rate of Korn Ferry has ranked No. 1 in the headhunting service and recruitment procedure outsourcing industry for two years in a row. In the fiscal year 2015, the revenue of Korn Ferry exceeded 1 billion USD for the first time. In the fiscal year 2017, the revenue of Korn Ferry increases to 1.622 billion USD. Its ranking rises by three places on HRoot Global 50 Human Resource Service Providers 2018, indicating a sound development momentum.

HR service outsourcing: Technological innovation

On HRoot Global 50 Human Resource Service Providers 2018, there are 11 Human Resource outsourcing service providers. Their revenue totals at 42.009 billion USD, of which 3.557 billion USD forms the operating profits. The Human Resource outsourcing service providers, ADP and CIIC, boast an revenue of above 10 billion USD. Their revenue reaches 12.38 billion USD and 11.256 billion USD, and ranks No. 5 and No. 6, respectively on HRoot Global 50 Human Resource Service Providers 2018. Compared with other segments of Human Resource service, the Human Resource service outsourcing industry has the highest return on equity and a higher annual income growth rate.

Development of the era has lifted management demands and layers to a new height. Human Resource service outsourcing has been evolved from the single project service into a systematic project. In general, suppliers should provide skills, procedures, practices, professional knowledge, technologies and other systematic solution plans. In recent years, Human Resource service outsourcing suppliers have been vigorously introducing new technologies, succeeding in creating integrated solution plans for the Human Resource management and service procedure outsourcing based on the Human Resource SaaS model in response to the era development need.

Human resource management software: Emergence of cloud computing service

In the fiscal year 2017, the Human Resource management software industry is booming. On the rankings, there are six Human Resource management software suppliers. Five are from the US and one from India. Workday, KRONOS, and Ultimate Software are on the top with their revenue at 1.569 billion USD, 1.3 billion USD and 941 million USD in the fiscal year 2017. The total revenue of the three enterprises accounts for 73.3% of the total from the Human Resource management software industry.

The Human Resource management software industry features a high threshold, a large input, and a long period. Therefore, there is still a long way to go for the Human Resource management software industry to make profits. Benefiting from development of cloud computing, big data and digitalization, many enterprises have revolutionized the Human Resource management system, fueling a vigorous market demand.

Human resource consulting: Dominated by four giants

There are four Human Resource service suppliers listed on the rankings. They are Willis Towers Watson, Aon Hewitt, MERCER, and RESOURCES GLOBAL PROFESSIONALS. The revenue of the four institutions totals at 17.917 billion USD in the fiscal year 2017, registering a year-by-year increase of 5.4% compared with the fiscal year 2016.

Online recruitment: Business expansion

On the rankings, there are three online recruitment suppliers. The total revenue of the industry is 2.06 billion USD in the fiscal year 2017, which is 150 million USD higher than that in the fiscal year 2016. The online recruitment service segment is on the whole smaller than that of the other Human Resource service segments. However, the average operating profit ratio of the industry is the highest, averaging at 16.1%.

As the largest online recruitment website in Australia, Seek’s international business department includes zhaopin.com, Seek Asia, Brazil Online, Online Career Center (OCC). Contributions of the international business department to Seek’s finance are tremendous and still growing.Recruit Holdings is a Japanese Human Resource service giant. Recent years have witnessed its active expansion of the online recruitment market. Besides, with a growing demand for flexible labor use, the freelancer online recruitment market has been developing rapidly.

M&A tide: Competition in the era of digitalization

Digitalization can improve the internal operation efficiency through optimization of cost management, procedures, and customer experience. Therefore, digitalization remains both a challenge and opportunity to companies. At present, many companies give top priority to development of digitalization. They are seeking a more rational way to promote their business development via M&A. Willis Towers Watson once carried out a survey, showing that around three fourths (74%) of insurance companies in the world think that the insurance industry cannot lead digital innovation in the future. Around half of insurance companies have the plan to acquire new technologies via M&A in the coming three years.

Companies with digital tools and digitalization learning opportunities will be more attractive and competitive. The importance of digitalization has been realized by many companies. This justifies a large number of them introduce digitalization. The phenomenon is also universal in the Human Resource service industry. In December 2017, MERCER purchased PROMERIT, a consulting company specializing in Human Resource digitalization and transformation, aiming at increasing its position in the German market. In February 2018, The Adecco Group purchased the recruitment startup, Vettery, at the price of around 100 million USD to speed up its digitalization. In April of the same year, it once again purchased GENERAL ASSEMBLY, a platform providing occupational education and digital skill training.

By driving development of service via the leading technology and innovation, the Human Resource service process has become more intelligent, simplified and efficient. Currently, more and more companies have been aware of the importance to deploy the digitalization strategy and improve employees’ digitalization skills. More and more capitals have been gathering in the Human Resource service market to make various technological innovations possible. “Technology & Service” is the main strategy of Randstad in recent years. Meanwhile, “Digital Factory” has been set up to help Randstad and other companies cope with technological issues in the Human Resource field through continuous improvement and innovation of tools. At the same time, more possibilities and development potential can be mined.

In May 2018, institutions such as CIIC have set up the CIIC Ruili Human Resource Industrial Fund. As the first industrial investment fund in the Human Resource service industry in China, it will actively introduce quality investors to promote integration and upgrade between the Human Resource industry and new technologies, including artificial intelligence and big data to help expand the value chain of invested businesses to the higher chain to form a stronger competitive edge and to shape advantageous companies in the vertical field of certain industry.

Technology has changed life. Intelligent CV screening, artificial intelligence chatting robots have participated in preliminary communication and game-based psychological evaluation of candidates. More and more Human Resource technologies, including the freelancer management system, are increasingly utilized by more and more people. A new digital Human Resource solution plan and tool are completely changing the way how people connect themselves with work. With entry of capitals and technologies into the Human Resource service industry, the Human Resource service will be transformed to professional technological service combining the Internet with the artificial intelligence. In this way, new thinking, services, technologies and products in the Human Resource field will be emerging, fully reforming the current model of the Human Resource service industry and reconstructing the labor market.

Table 7 2017-2018 Major M&A in Global Human Resource Service Market

| Time | M&A |

| Jun.2017 | Recruit Holdings acquired TrustYou, the world's largest guest feedback platform |

| Aug.2017 | Indeed.com acquired job assessment tech provider Interviewed |

| Aug.2017 | On Assignment acquired Boston-based clinical/scientific staffing provider Stratacuity |

| Aug. 2017 | Aon Groep Nederland acquired Unirobe Meeùs Groep (UMG) for EUR 295 million to reinforce the business of risk, retirement and health solutions |

| Aug. 2017 | Workday acquired the development team behind Pattern for team collaboration |

| Aug. 2017 | Paychex acquired PEO provider HR Outsourcing Holdings |

| Sep.2017 | ManpowerGroup acquired Event Elite, the leading One-Stop marketing agency in Hong Kong |

| Sep.2017 | Lee Hecht Harrison, a division of The Adecco Group, acquired Iowa career consulting firm |

| Sep.2017 | The Adecco Group acquired BioBridges, a Boston-based firm providing integrated clinical development services, including personnel, to the life sciences sector |

| Sep.2017 | 51job.com invested 120 million U.S. dollars to become Lagou's largest shareholder |

| Sep.2017 | Heidrick acquired Amrop Denmark,a Danish search and leadership consulting firm, in $8.4 million deal |

| Oct.2017 | The Adecco Group acquired New York-based outplacement provider Mullin International |

| Oct.2017 | ADP acquired payment card firm Global Cash Card to enhance the business of existing payment card offering |

| Oct.2017 | Career International invested CAIDAO, a Human Resource management software service provider |

| Dec. 2017 | The Adecco Group acquired CMAST, a consultancy and project management company in the life sciences sector |

| Dec. 2017 | Mercer agreed to acquire Frankfurt-based Promerit, a consultancy specialising in HR digitalisation and HR transformation |

| Dec. 2017 | Aon acquired Leeds-based Henderson Insurance Broking Group to boost the firm's capacity in the mid-market and bespoke solutions segments |

| Jan. 2018 | ADP Acquired Freelancer Management System Provider WorkMarket |

| Jan. 2018 | Career International acquired RRCT Service Outsourcing, a financial outsourcing services provider |

| Feb.2018 | TS2 Holdings LLC acquired three California companies in the executive recruiting space including Neohire South,RockIT Recruiting and Hero.jobs |

| Feb.2018 | The Adecco Group acquired Vettery with around $100 million in order to accelerate the development of the Adecco Group's digital strategy |

| Mar.2018 | Paychex announced the acquisition of Lessor Group (Lessor), a market-leading provider of payroll and human capital management (HCM) software solutions |

| Mar.2018 | Recruit Holdings invested in ScoreData, a provider of AI applications to improve customer satisfaction levels and conversion rates in clients |

| Apr.2018 | Recruit Holdings announced that that it will acquire the website and assets of Canadian job site, Workopolis.com through its subsidiary Indeed |

| Apr.2018 | Kronos Incorporated announced that, through its wholly owned subsidiary Kronos SaaShr, it has entered into a definitive agreement to acquire substantially all of the assets of Advanced Payroll Systems, a payroll services bureau and human capital management solutions provider |

| Apr.2018 | Beijing Career International announced that it plans to acquire a 52.5% stake in UK recruitment firm Investigo |

| Apr.2018 | The Adecco Group acquired General Assembly, a training firm focused on IT skills |

| May.2018 | Recruit Holdings agreed to buy Glassdoor Inc for $1.2 billion to gain the access to the U.S. job-website operator's vast database of company reviews and salary data |

| May.2018 | The Adecco Group Japan announced that it has acquired all the shares in Tokyo-based A-STAR an AI matching platform for freelancers working in the IT and web industries |

| Jun.2018 | Online job advertiser Indeed has acquired Canadian-based Resume.com, an online service for creating personalised résumés |

| Jun.2018 | Workday acquired Rallyteam, a Human Resources intelligent matching platform, to fuel machine learning efforts |

| Jun.2018 | HRnetGroup, the biggest recruitment agency in Singapore, has entered into definitive agreements relating to its acquisition of REForce (Shanghai) Human Resources Management Consulting Co. |

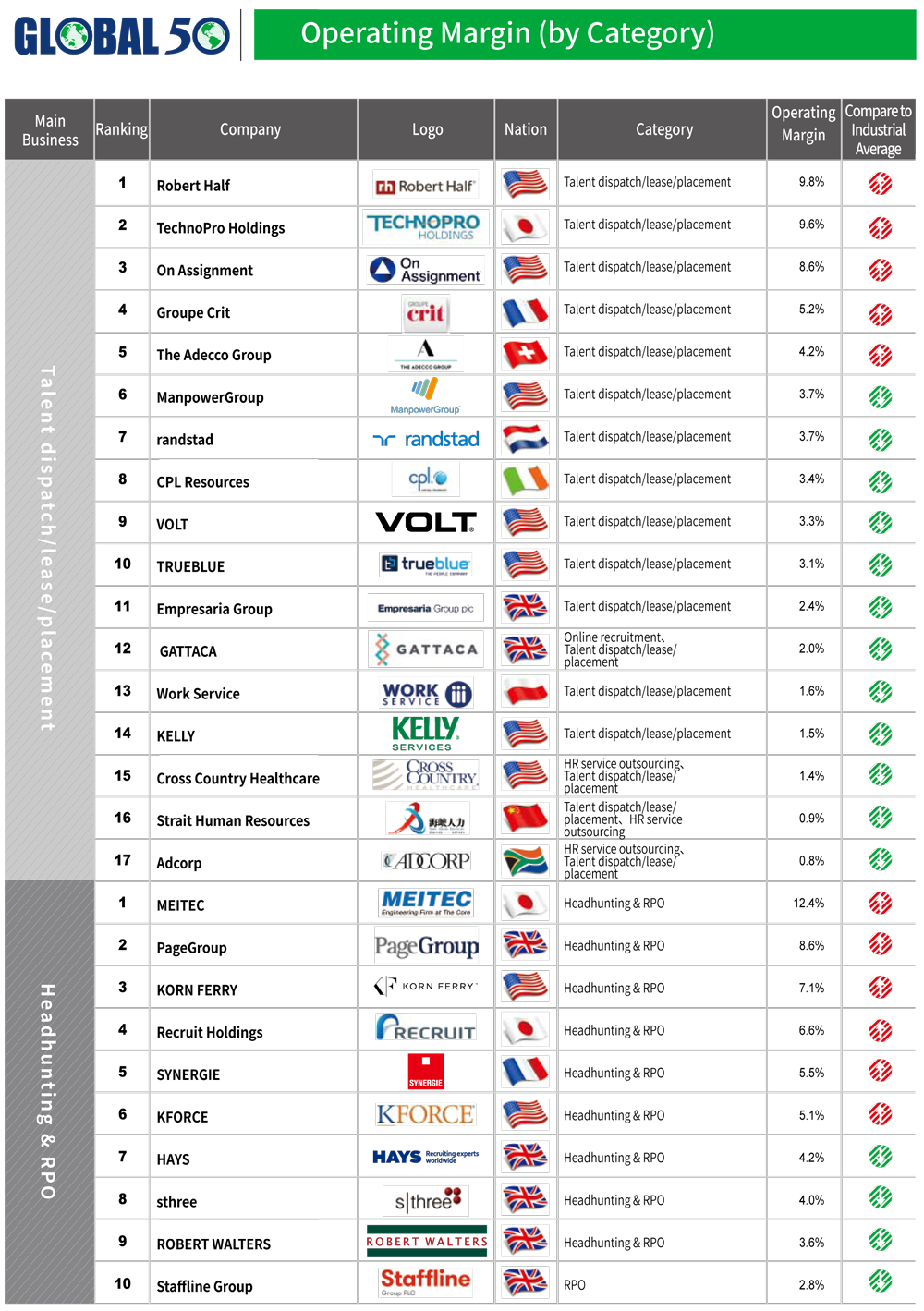

In this report, there are 6 sub-rankings: HRoot Global 50 Human Resource Service Providers 2018(by Country)、HRoot Global 50 Human Resource Service Providers 2018(by Category)、HRoot Global 50 Human Resource Service Providers 2018(by Annual Revenue Growth Rate)、HRoot Global 50 Human Resource Service Providers 2018(by Operating Margin)、HRoot Global 50 Human Resource Service Providers 2018(by Per Capital Income)、HRoot Global 50 Human Resource Service Providers 2018(by Per Capital Operating Profit). According to the 6 main business categories, compare the 10 financial ratios in their respective fields. In addition, there are major financial data and financial ratio tables in Fiscal 2017 for 50 companies.

HRoot Global 50 Human Resource Service Providers 2018(by Category)

HRoot Global 50 Human Resource Service Providers 2018(by Per Capital Operating Profit)

HRoot Global 50 Human Resource Service Providers 2018 Operating Margin (by Category)

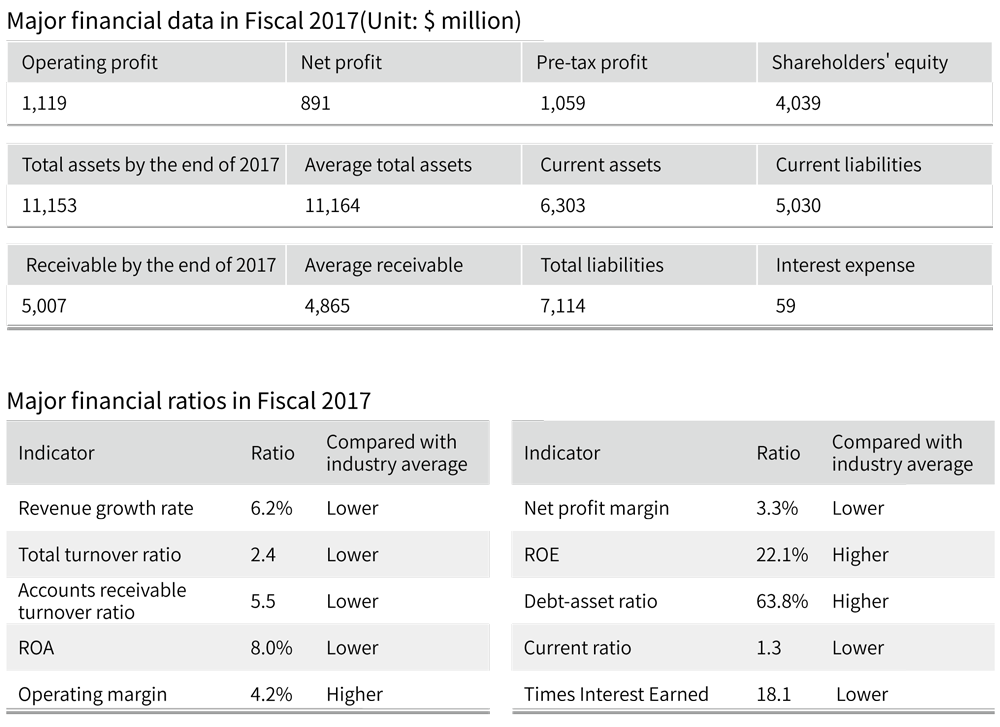

The Adecco Group’s major financial data and financial ratios in Fiscal 2017

This is a short version of the report. To read the full report, click on the purchase online.