SUMMARY

Rushing between Torrents, Moving forward in Turmoil

——An Evaluation of the Global Human Resource Service Market 2019-2020

2020, Turbulence is again

Affected by long-term trade disputes, the global economic growth rate dropped to 2.3% in 2019, which is the lowest level in the past ten years. At the beginning of 2020, as the overseas epidemic continued to ferment, the world economy fell into recession, and unstable and uncertain factors increased significantly. According to the World Economic Situation and Prospects 2020 released by the United Nations, the global economy is expected to shrink by 3.2% in 2020 due to the COVID-19. The report predicts that from 2020 to 2021, the cumulative loss of global economic output will reach $8.5 trillion, almost erasing all the growth in the past four years. In 2020 China government work report, the much-anticipated GDP growth rate did not appear. This is the first time since 1994 that China began to set economic growth targets.

The rapid spread of COVID-19 has brought unprecedented impact on the economic operations all over the world. All industry chains have been hit, and economic development has been stalled. Jacques van den Broek, CEO of Randstad, said: "The government plans in many countries around the world have temporarily protected the stability of jobs, but this is unsustainable. Obviously, many jobs that existed before the outbreak were suspended. After that, it will likely take years to restore the level of work before the outbreak."

In April 2020, Randstad, the Adecco Group, ManpowerGroup, three global human resources service companies jointly initiated the formation of a human resources service industry alliance to help companies and employees at the right time return to work safely and return the business to the right track. After collecting and analyzing more than 400 enterprise instances in 5 major industries in 13 countries and regions, the Alliance released the "Safety Re-work Guide", which aims to provide suggestions and practical guidelines for enterprises to resume work under the premise of ensuring the health and safety of employees.

With the increasing complexity of the global economic, society, and political environment, as well as the accelerated development of emerging technologies such as artificial intelligence, automation technology, and cloud computing, companies are facing the challenges of transformation and remodeling, and at the same time have an important impact on the demand for human resources services market. The list of HRoot Global 50 Human Resource Service Providers 2020 reflects this trend.

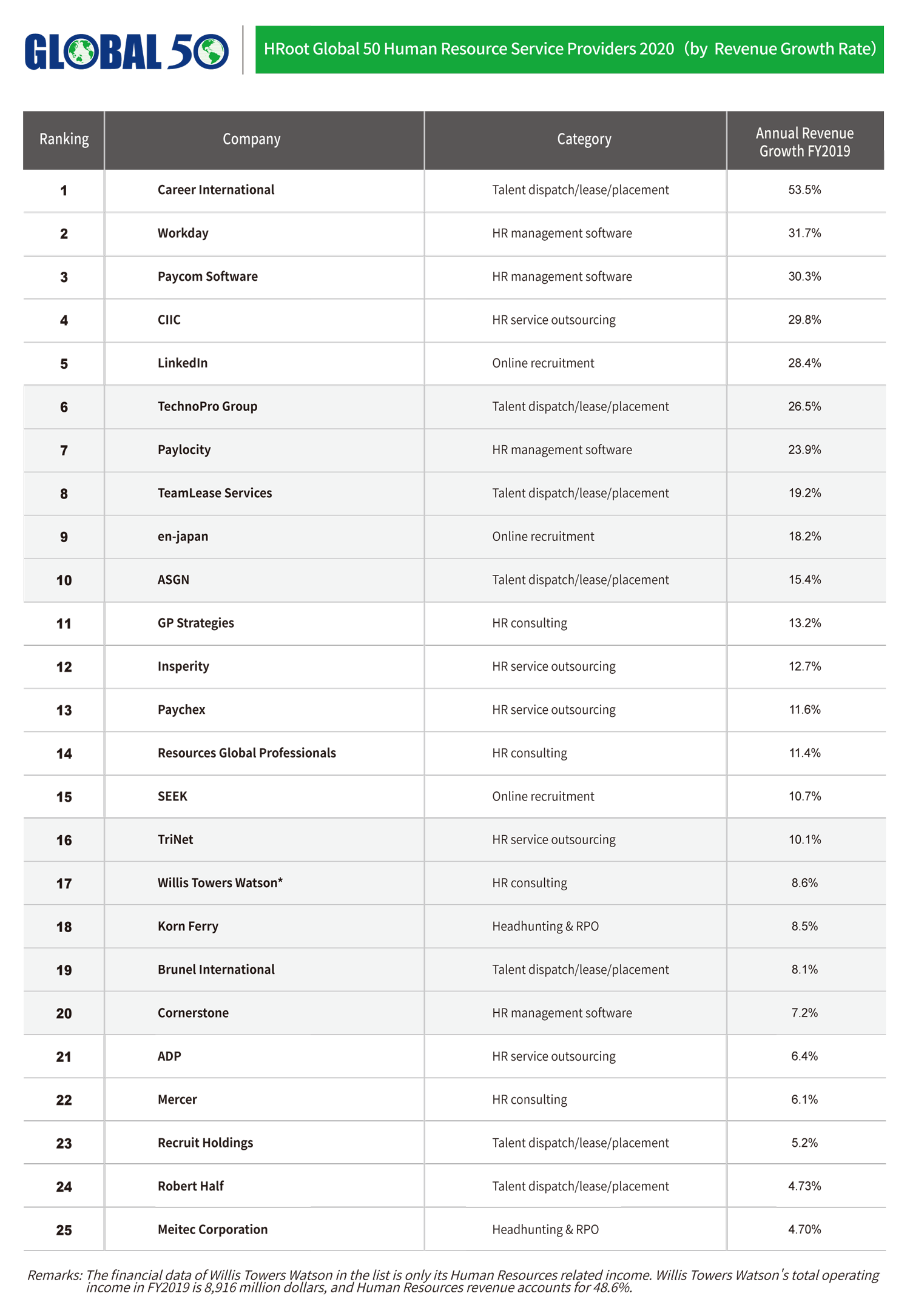

The HRoot Global 50 Human Resource Service Providers 2020 is ranked based on the company's revenue in FY2019, and the company's revenue is uniformly converted into USD to eliminate the influence of the annual interest rate fluctuations on rankings.

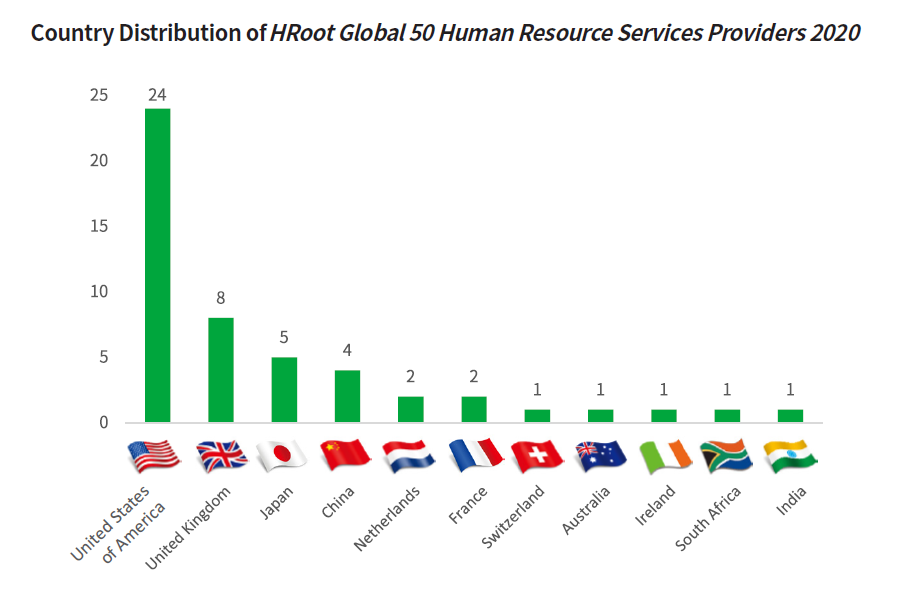

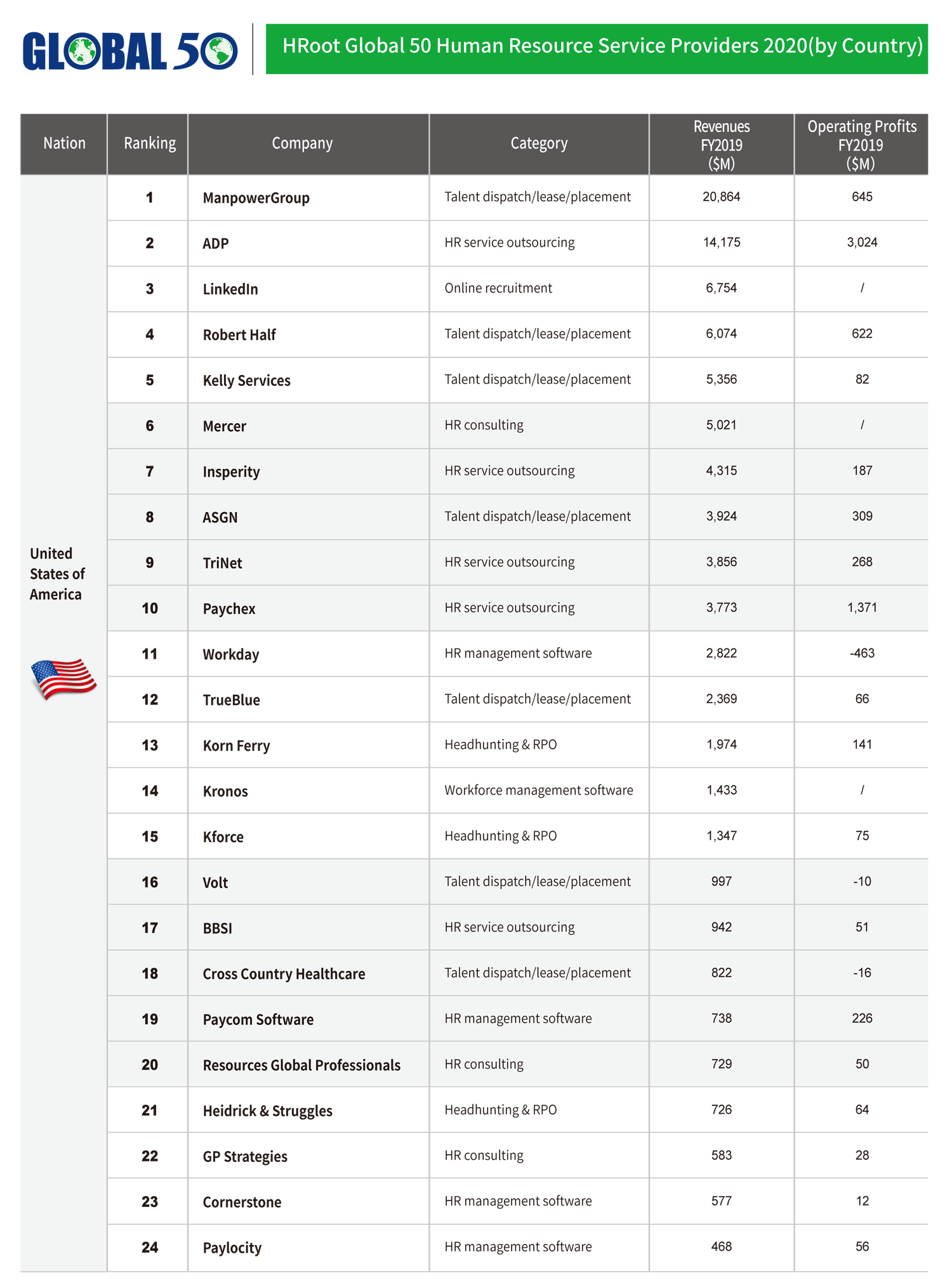

The companies of HRoot Global 50 Human Resource Service Providers 2020 come from 11 countries around the world, including 24 companies headquartered in the United States, 8 in the UK, 5 in Japan, 4 in China, 2 in the Netherlands, etc.

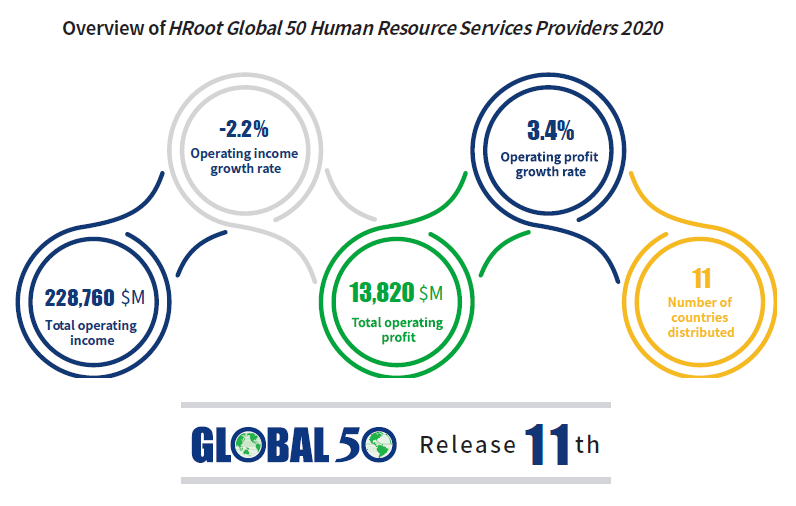

The threshold for entry has dropped from $530 million last year to $468 million. The combined revenue of the companies in the FY2019 is $228.8 billion, a decrease of 2.2% from the total revenue of the Top50 in the last year, but the total operating profit increased by 3.4% than the previous year.

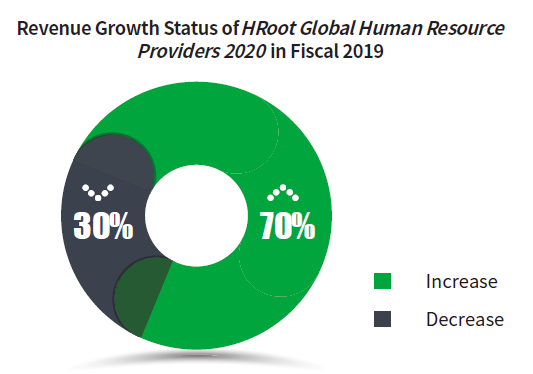

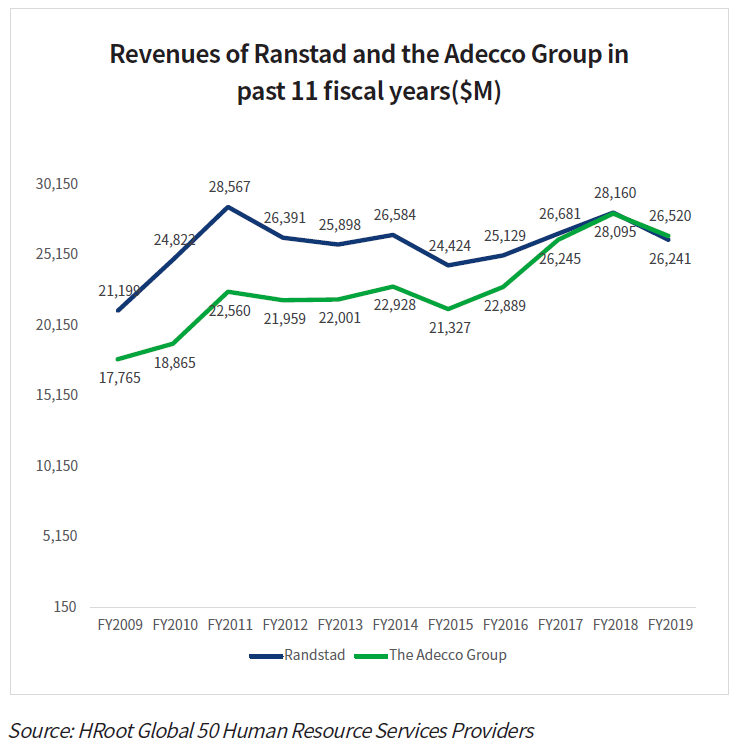

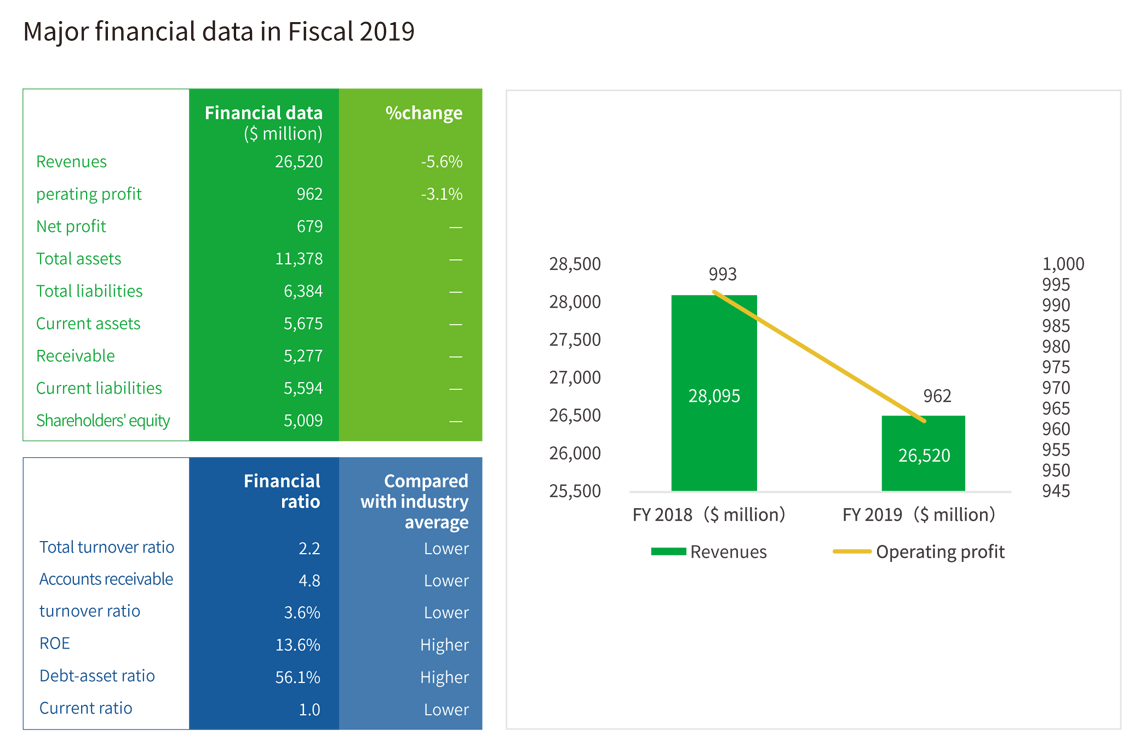

Among the HRoot Global 50 Human Resource Service Providers 2020 companies, 70% of the companies' revenue is in a state of growth. Compared with FY2018, the number of companies with increased revenue decreased by 8 companies. With continued trade tensions and geopolitical uncertainty in Europe, Randstad and the Adecco Group's revenue in FY2019 decreased by 5.6% and 6.8% year-on-year.

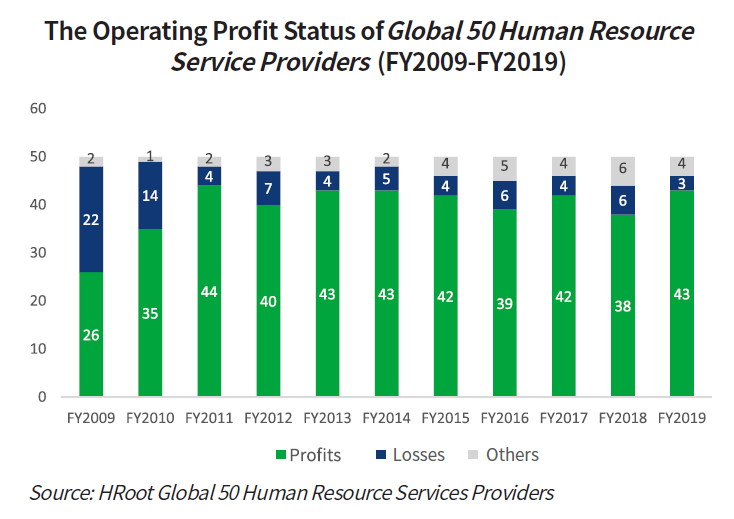

Although the number of companies with increased revenue is decreasing, the number of profitable companies has increased relatively. In the total list of HRoot Global 50 Human Resource Service Providers 2020, a total of 43 companies achieved profitability. With great uncertainty in the business environment, the profitability of enterprises has been further tested, more and more companies have used the technology to reduce costs and increase efficiency.

The top 10 global head companies have a great influence on the scale and stable development of the global human resources service industry. The total revenue of the top 10 companies in the list was $157.10 billion, which is a slight decrease from the previous year, accounting for 68.7% of the total revenue of the top 50 companies.

Among the top 10 of HRoot Global 50 Human Resource Services Providers 2020, Randstad, the Adecco Group, ManpowerGroup, CIIC, ADP and Hays have been in the top 10 for the past 11 years.

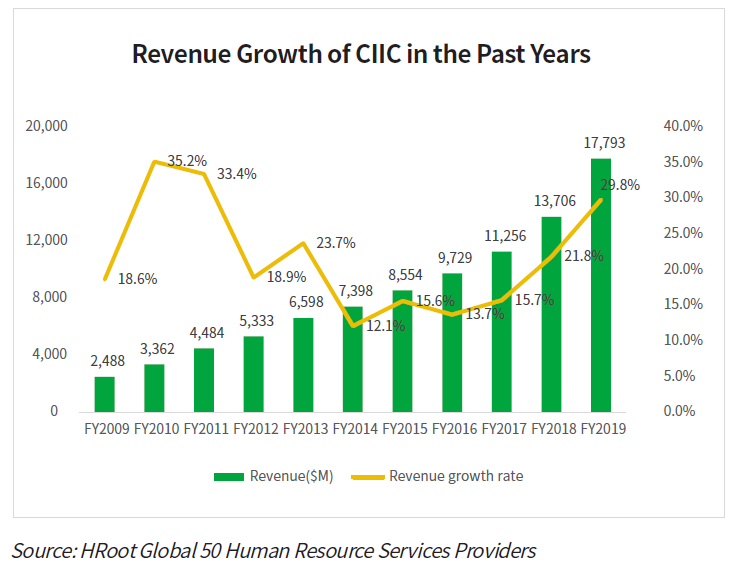

As the only Chinese company in the Top10, CIIC has a compound annual growth rate of 21.7% over the past decade. In FY2019, CIIC's revenue reached $17.8 billon, ranking fifth; operating income growth rate reached 29.8% year-on-year.

There are 6 companies with revenue exceeding $10 billion, and 4 companies with more than $20 billion. Among them, Recruit Holdings has crossed the $20 billion threshold for the first time. The four leading companies have maintained a ranking pattern for 7 years in a row, and there have been major changes this year.

Firstly, Randstad surpassed the Adecco Group for the first time, ranking No.1 on the list. Randstad has received a return on its growing diversified portfolio by region and business. Since FY2016, Randstad’s revenue has started to grow rapidly, continuously shrinking the gap and surpassed the Adecco Group in FY2019. According to Randstad's market share estimates, Randstad and the Adecco Group each accounted for 6%.

Recruit Holdings ranked 4th for a long time, surpassed ManpowerGroup for the first time and ranked 3rd on the HRoot Global 50 Human Resource Services Providers 2020. From FY2016 to FY2018, Recruit Holdings maintained a double-digit growth rate. Even in the turbulent FY2019, when the revenue of other head institutions fell, Recruit Holdings achieved a 5.2% revenue growth.

On the list of HRoot Global 50 Human Resource Services Providers 2020, in addition to CIIC, there are three other China companies on the list. 51job ranked 45th on the list with $579 million in revenue; Strait Human Resources, ranked 47th with $548 million in revenue; Career International entered the top 50 list for the first time with a revenue of $510 million, ranking 49th.

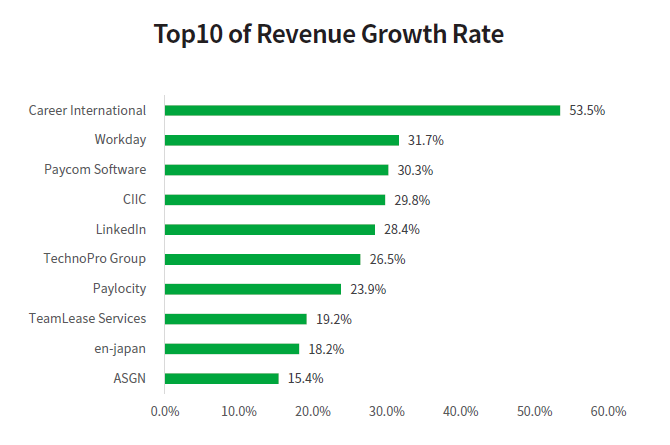

As one of the earliest human resource companies with flexible employment in China, flexible employment has become a rapidly growing business unit of Career International, accounting for 77.1% of its total revenue. In FY2019, Career International ranked No.1 on the list of revenue growth rates with a 53.5% revenue growth rate.

Human Resource Service Industry Segmentation

HRoot Global 50 Human Resource Services Providers 2020 involves six main businesses/segments, including talent dispatch/lease/placement services, headhunting & RPO, HR service outsourcing, HR management software, HR consulting and online recruitment. Among them, there are 19 companies focusing on talent dispatch/lease/placement services, followed by 10 headhunting & RPO. The numbers of HR consulting and online recruitment industry are both fewer than 5.

In terms of revenue of different industries, the revenue of talent dispatch/lease/placement service agencies is $126.90 billion, accounting for 55.5% of the total revenue, which is lower than last year. HR service outsourcing agencies ranked second with revenue of $53.76 billion. HR management software (2.9%) and online recruitment industry (3.9%) accounted for relatively low revenue.

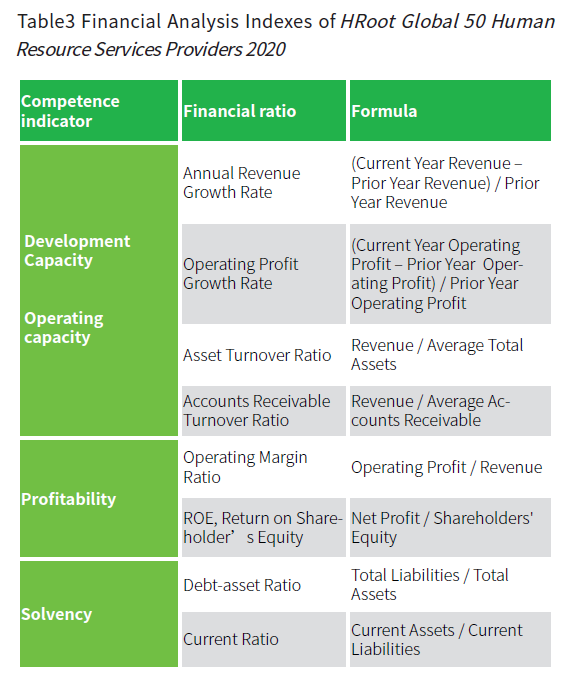

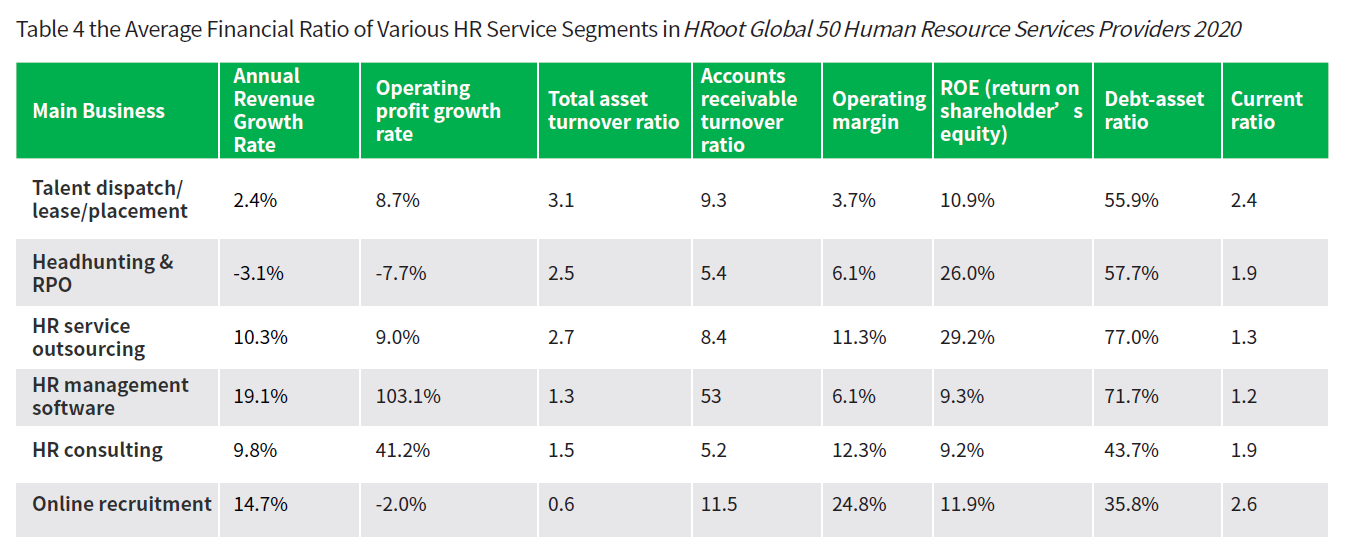

HRoot Global 50 Human Resource Services Providers 2020, by organically combining several internal ratios that are used to evaluate the operating efficiency and financial status of an enterprise, a complete index system is formed. In this white paper, eight indexes of four dimensions are compared to deeply examine the operation status of various human resource service institutions.

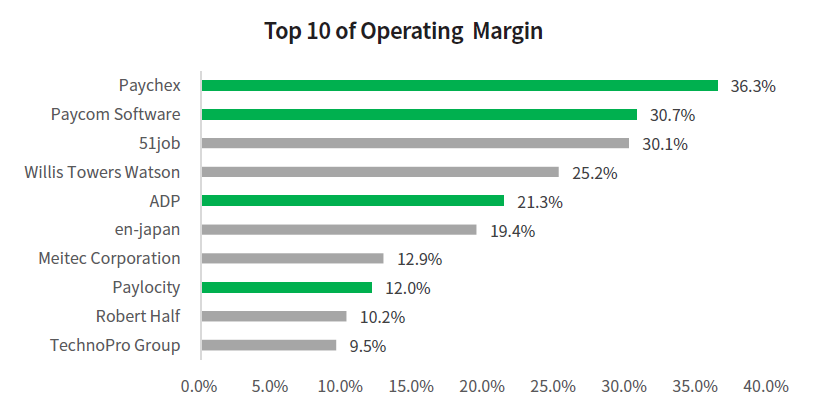

According to the financial ratios, the total asset turnover rate and accounts receivable turnover ratio of Strait Human Resources are relatively high, which shows stronger operational capacities; Insperity's ROE and debt-asset ratio are high, and profitability And strong solvency. Paychex, Paycom Software, ADP, 51job, Willis Towers Watson, Robert Half, and Meitec Corporation have strong profitability.

Paychex (36.3%), Paycom Software (30.7%) and 51job (30.1%) are in the top 3 on the operating profit margin list. From the perspective of the industry on the top 10 operating profit margin list, Paychex, Paycom Software, ADP, and Paylocity are all pay-related outsourcing or software providers. With high profit and high valuation characteristics, the entry threshold of salary services is relatively high. Once established, it is easy to form a monopoly and maintain a high operating profit rate.

On HRoot Global 50 Human Resource Services Providers 2020,the concept of industrial average value has been introduced as the baseline providing benchmark for different industries in human resource services. In this white paper, the industrial average value refer to various average financial ratios of the 50 HR service enterprises in terms of talent dispatch/lease/placement, headhunting & RPO, HR service outsourcing, HR management software, HR consulting, and online recruitment.

Remarks: Adcorp's talent dispatch/leasing/placement service agency Adcorp's operating profit growth rate in FY2019 is as high as 4,340.4%. The data is abnormal and it is not included in the statistical scope; Insperity from the United States human resources service outsourcing agency Insperity's net asset in FY2019 The rate of return is as high as 3,685.4%, the data is abnormal, and it is not included in the statistical scope.

From the perspective of the industry average, the revenue growth rate, operating profit growth rate and accounts receivable turnover ratio of the HR management software industry are the highest. Among them, the revenue growth rate was 19.1%, and Workday ranked 2nd on the revenue growth rate list with a revenue growth rate of 31.7%; the operating profit growth rate reached 103.1%, much higher than other sub-sectors. In FY2019, Cornerstone achieved a turnaround from loss to profit, with an operating profit growth rate of up to 253.6%. Paylocity’s operating profit also increased further from the previous year, with an operating profit growth rate of 252.5%.

Talent dispatch/lease/placement service: Digital transformation pays off

Technology is redefining the boundaries of the human resources service industry, and the global digital megatrend is changing the world’s working model. For example, employers need to manage their workforce flexibly, and employees need to manage their careers flexibly.

On HRoot Global 50 Human Resource Services Providers 2020, the top four companies are all talent dispatch/lease/placement providers. The attributes of this subdivided industry are more likely to produce scale effects, but the competition is extremely fierce. In FY2019, Randstad surpassed the Adecco Group ranking No.1 on the HRoot Global 50 Human Resource Services Providers 2020 for the first time, becoming the largest human resources service organization.

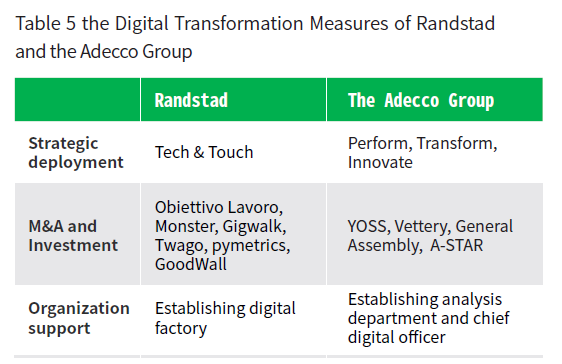

In the digital age, the key to enterprise competition depends on the speed and intensity of digital transformation. These traditional human resource service agencies are actively seeking technological innovation. Judging from the digital transformation measures of Randstad and The Adecco Group, the formulation of clear digital strategic plans, acquisition or strategic investment technology platforms, and the establishment of digital departments or digital positions are common characteristics.

The traditional talent dispatch/lease/placement service market is more offline. With the further development of the gig economy, more talent dispatch/lease/placement service companies will choose the low-cost business model provided online. According to the prediction of Staffing Industry Analysts, the world's leading industry research organization, the revenue of the global Staffing Service industry is expected to decline by 14% to 37% in 2020, and growth will resume in 2021.

Headhunting & RPO: diversified integration and development

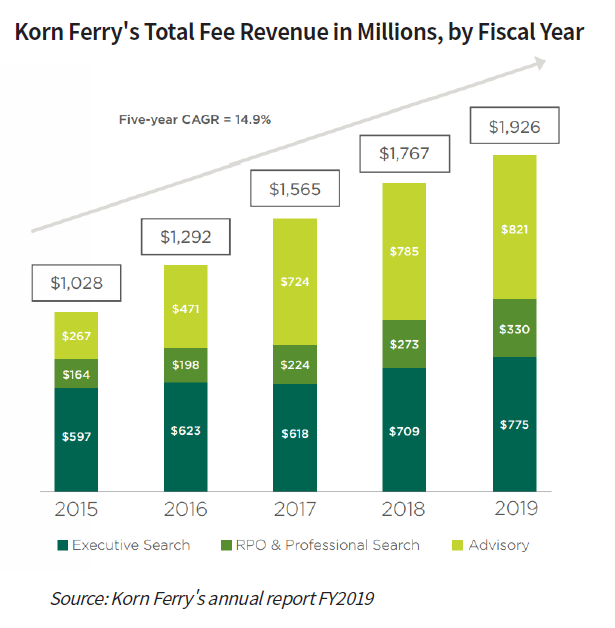

There are 10 headhunting & RPO service providers on HRoot Global 50 Human Resource Service Providers 2020. In FY2019, their total operating income is $21,827 million, operating profit is $1,166 million, and the industry's average operating profit rate is 6.1%. Among them, Hays had revenue of $7,752 million, and was the only provider of headhunting & RPO services in the top ten. The top three companies in the headhunting & RPO industry have the highest revenue growth rates are Korn Ferry, Meitec Corporation, and SThree, which are 8.5%, 4.7%, and 2.4%, respectively.

Since the acquisition of Hay Group in 2015, Korn Ferry's revenue has been increasing for 5 consecutive years. Starting in 2017, the consulting business has become the highest-revenue business among the three major business types of Korn Ferry, accounting for 42.6% in FY2019.

The mid-to-high-end talent search industry is greatly affected by the macro economy, and the power of enterprise expansion is more urgent during the upward phase of the economic cycle. The demand for talents is increasing, and it is also willing to provide higher remuneration for high-end talents. During the downturn of the economic cycle, companies are more cautious about talent selection, budgets for talent recruitment will also be tightened, and income growth in the headhunting industry will also decline. Affected by the uncertainty in 2020, headhunting & RPO will face more challenges.

Human resource service outsourcing: Vertical division of labor and industry refinement

In the 1970s, under the impact of the oil crisis, North American companies faced a complex external operating environment. At the same time, social progress has made the government continue to improve the relevant welfare laws and regulations. Enterprises have paid more attention to the health and safety of employees than ever before, making corporate administrative personnel work more complicated. In order to reduce labor costs and employment risks and maximize efficiency, companies outsource these emerging human resources businesses and choose professional human resources service companies to complete transactional work. Human resources service outsourcing service providers came into being.

ADP is currently the world's most valuable human resources company. According to HRoot Market Value of Global Human Resource Service Providers in June 2020, ADP ranked first with $64.758 billion. In fiscal 2019, ADP’s revenue increased 6% to $14.18 billion, and net profit was $2.29 billion, up 22% year-on-year.

With the increase in the degree of professionalization of human resources, the service targets of human resources will begin to differentiate, and the requirements of various companies for their services will also be more personalized. The professional division of labor system of human resource suppliers will also continue to be meticulous and perfect, with more emphasis on providing customers with targeted and differentiated products to meet the needs of different enterprises. In the future, human resources outsourcing will develop in a more professional and refined direction.

Human resource management software: Cloud era accelerated

With the influence of economic globalization, the scope of business activities of enterprises is no longer limited by time and space, but it is also facing an increasingly complex employment environment and rising labor management costs. The disappearance of the demographic dividend, and the individual's continuous attempts to work freely, which demands for more efficient, flexible, and refined management of labor management. The outbreak of the COVID-19 has produced the employment mode of shared employee, allowing all enterprises in various industries to rethink the strategy of the workforce management, what flexible employment rate should be maintained, and how to achieve agile management of the employee team. Ceridian's Future of Work Report estimates 71% of companies in North American will rely on contractual and freelance workers in 2020 and 2021, which is the key to addressing the skills gap in highly specialized areas.

The SaaS service model is favored by enterprises due to its flexible payment and fast iteration characteristics. With the eruption of digital demand, the market size of human resource SaaS is growing rapidly. Technological proliferation in the field of big data analytics, machine learning, artificial intelligence (AI), and Internet of Things (IoT) is expected to positively impact the market for human resource management. According to a report by Grand View Research, the global human resource management market size is projected to attain $30billion by 2025, exhibiting a 10.4% CAGR during the forecast period (2019-2025).

Human resources consulting: Professional focus

In 2020, there are 4 human resources consulting services listed on the rankings, namely Mercer, Willis Towers Watson, and Resources Global Professionals and GP Strategies. Human resources consulting business revenue of the four institutions was $2.67 billion in fiscal 2019.

Willis Towers Watson is a leading global advisory, broking and solutions company that helps clients around the world turn risk into a path for growth. Willis Towers Watson's total revenue in fiscal 2019 was $8.92 billion, and human resources consulting related business revenue was $4.33 billion, accounting for 48.6% of total revenue, ranked 13th in the HRoot Global 50 Human Resource Service Providers 2020. Operating profit margin reached 25.2%, the highest profit margin in this segment. Human Capital & Benefits is the largest segment of Willis Towers Watson, accounting for 36.9% of total revenue, and the product line covers offerings–retirement, health & benefits, talent& rewards, and technology and administration solutions.

GP Strategies, is a global performance improvement solutions provider of training, digital learning solutions, management consulting and engineering services. It was established in 1959 and entered the HRoot Global 50 Human Resource Service Providers 2020 for the first time this year. In fiscal 2019, GP Strategies' revenue was $580 million, ranking 44th in the list. Revenue increased by 13.2% compared with the same period of the previous year, with the highest revenue growth rate in this segment.

Online Recruitment: Differentiated Competitive Advantage is Highlighted

Online recruitment is a service that connects people and jobs through the Internet and matches the needs of employers and candidates. Efficient, precise, simple and time-saving are the basic needs of online recruitment services.

There are 4 online recruitment companies on the list of HRoot Global 50 Human Resource Service Providers 2020, from the United States, Australia, China and Japan. In fiscal year 2019, total revenue in the online recruitment sector was $8.94 billion. LinkedIn's operating income in fiscal year 2019 was $6.75 billion, an increase of 28.4% from fiscal year 2018, ranking 9th in the overall list, and is currently the largest recruitment organization.

Online recruitment service agencies use new technologies to continuously innovate and transform, develop, improve the efficiency of job matching through technical means, extend the scope of services, integrate the platform's own resources, and deploy the human resource service ecosystem to provide job seekers at all stages of their careers One-stop service for human resources.

Industry Reshuffle and New Stars Rising

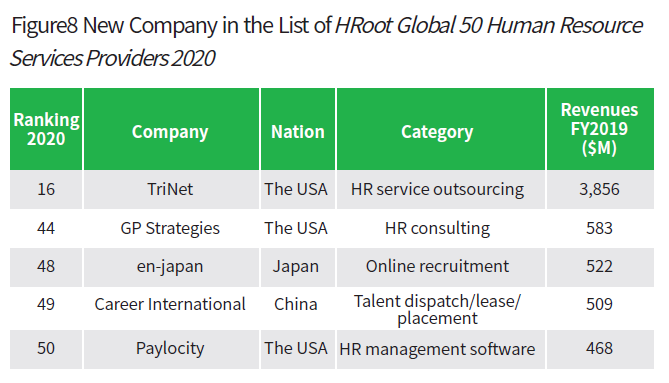

In the list of 2020 HRoot Global 50 Human Resource Service Organizations, there are 5 new companies on the list.

Compared with last year, it’s failed to obtain Allegis Group and Aon Hewitt financial data; Brunel International and Work Service SA delayed disclosure Fiscal Year 2019 financial report; Ultimate Software sold the company to PE agency Hellman&Friedman for $11 billion in May 2019 to complete the privatization.

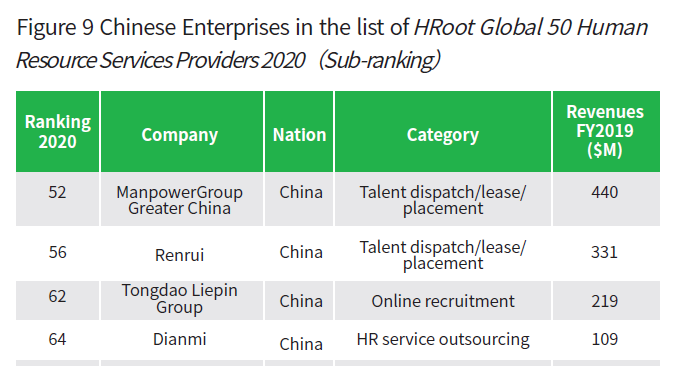

In the "2020 HRoot Top 50 Global Human Resource Service Organizations" sub-list, there are four companies from China, ManpowerGroup Greater China, Renrui, Tongdao Liepin Group and Dianmi Technology. They are the 52nd, 56th, 62nd and 64th positions on the sub-list. Four companies have positive growth in their operating profit margins in fiscal year 2019.

On the evening of May 13, 2020, Qiangsheng Holdings’ major asset restructuring plan was announced. It is worth noting that 100% of the shares of Shanghai Foreign Service (Group) Co., Ltd. will backdoor Qiangsheng Holdings achieved listing. Perhaps more Chinese companies can be seen on the list in the future.

New Trends in M&A: Technology M&A Boom is Spreading

As an important part of corporate development strategy, mergers and acquisitions are not only an internal need for companies to improve operational efficiency or scale effects, but also one of the effective means for companies to respond to external changes. Through reasonable mergers and acquisitions, companies can improve and straighten out the order of market supply and demand, realize the reallocation of economic resources, and obtain maximum profits.

The human resources market is an extremely fragmented market and there is a lot of room for integration. Many large international human resource service companies have acquisitions and mergers in the process of development and growth.

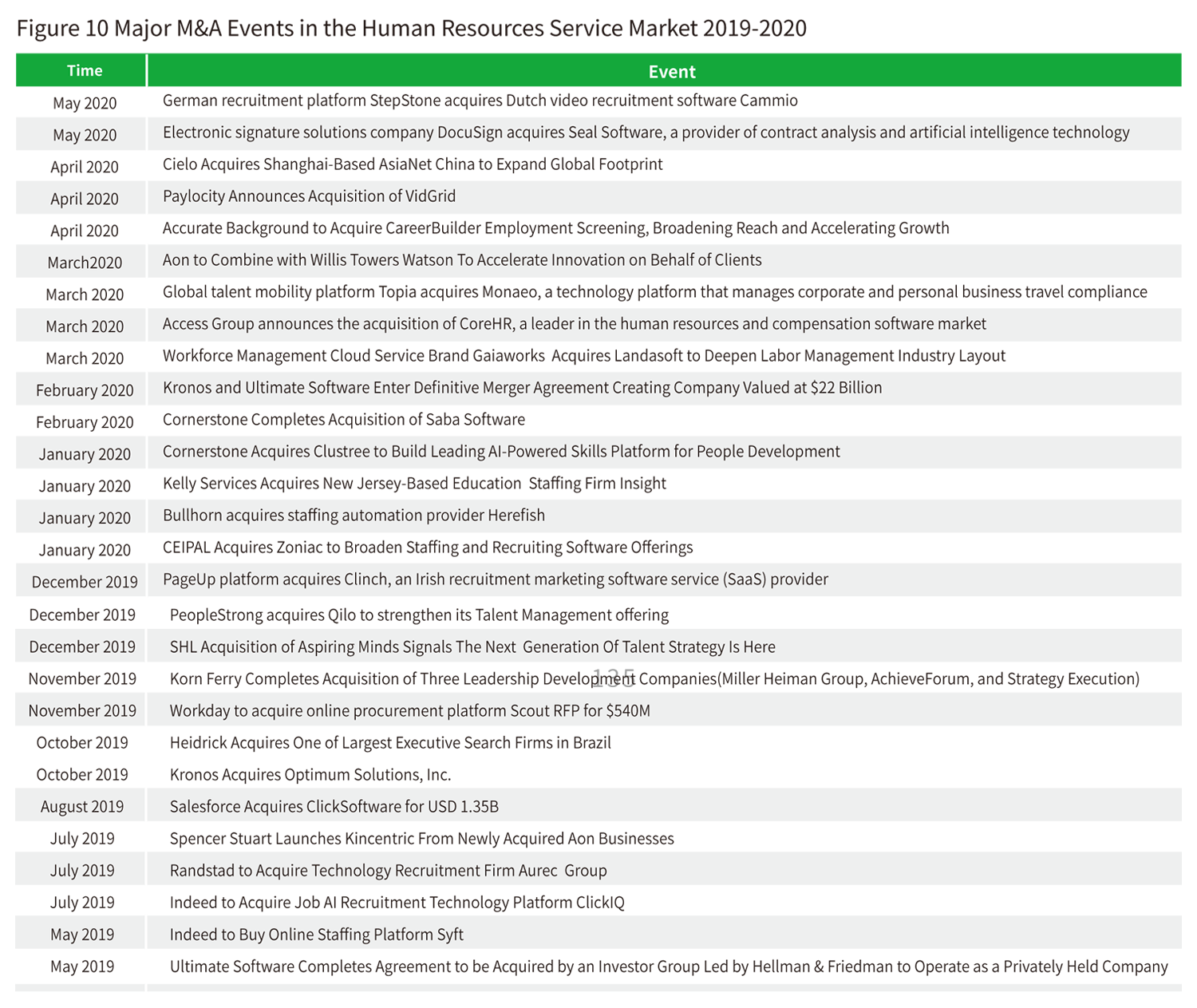

At present, cloud technology-related content including software, platforms and infrastructure services is becoming the main driving force of the digital revolution, and this field has undoubtedly attracted many M&A invitations. Among the 50 human resource service organizations on this list, mergers and acquisitions in the field of human resource software are relatively active. Human resource management software provider Workday acquired the online procurement platform Scout RFP for $540 million; human resource management software provider Cornerstone OnDemand acquired Clustree to establish a leading AI technology-driven talent development platform. In addition, Kronos, a labor management software provider, and Ultimate Software, a human capital cloud service solution provider, reached a final merger agreement. The new company is valued at $22 billion. In addition, since May 2019, hunting and recruitment business areas have also been active.

Technology-driven trends and innovations will continue to change future work. The company's human resource management system looks forward to optimization, upgrading, transformation and reshaping driven by these new technologies. Human resource service agencies actively establish an ecological chain that serves the entire life cycle of users, play a synergistic role, and improve their ability to withstand risks. This is also the opportunity for the new human resource service agency.

More and more acquisitions and integrations are a sign of the gradual maturity of the market, but for most of companies, acquisitions are only the beginning, and subsequent integration is the key.

Globalization is profoundly changing the entire world, and it has also brought extensive and profound changes to the human resource service market. According to the International Labor Organization’s report in early 2020, insufficient decent work, increased unemployment and persistent inequality in employment make people want a better life through work more difficult.

......

With the drastic changes in the global social, economic environment and the rapid development of digitalization, the human resource service industry will continue to show a rapid development trend. The industry development model, products, technology, and market are changing rapidly, and technology-based and platform-based human resource service organizations continue to emerge. Capital, industry and the market are concentrating on the digital application of human resources on a large scale. The application of human resources technology and the digital age is approaching, and the human resource service market is in the direction of system scale, high-end business formats and operational compliance trend.

Randstad's major financial data in FY2019

This is a short version of the report. To read the full report, click to download.