Accelerate Integration, Coordinate Development

——An Evaluation of the Global Human Resource Service Market 2018-2019

2019, a Slow down in Global Economic Growth

In 2018, global trade dispute escalated and the global trade growth slowed from 5.3% in 2017 to 3.8%. Due to the escalation of trade disputes, the emergence of financial stress and volatility risks, and geopolitical tensions, the economic growth of many countries will be weakened in 2019. The World Economy Situation and Prospects 2019 issued by the United Nations points out that with the weakening of the fiscal stimulus measures of 2018, the economic growth in US is expected to slow to 2.5% in 2019 and to 2% in 2020. China’s economic growth will slow down from 6.6% in 2018 to 6.3% in 2019.

The world economy is slowing down, protectionism is arising, global economic and commercial rules are evolving, and the world’s political and economic environment is undergoing profound changes. In the slowdown and downturn cycle of economic growth, the human resource service industry meets the needs of enterprises for cost control and the optimization of the workforce. As a result, the world human resource service market will keep growing steadily. The trend is also demonstrated by the Ranking & Whitepaper of Global 50 Human Resource Service Providers 2019 released by HRoot. The rankings is compiled according to the enterprise’s revenue in the fiscal year of 2018. At the same time, the average annual exchange rate between the local currency and US dollars is adopted to convert enterprises’ sales revenue presented into USD to eliminate the influence of the annual interest rate fluctuations on rankings.

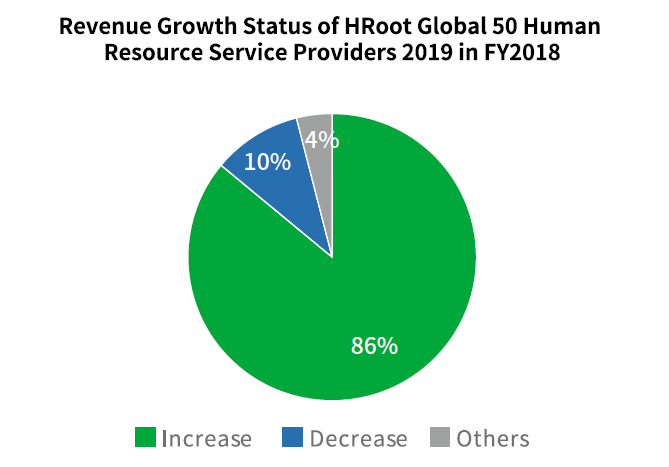

This year, the threshold for HRoot Global 50 Human Resource Service Providers 2019 is increased to $530 million from $410 million last year. Data show that the FY2018 revenue of all enterprises listed on the rankings totals at $234.06 billion. Compared with $201.71 billion in the previous fiscal year, the total revenue increased by 16.0% in FY2018. There are 7 enterprises’ operating revenue of more than $10 billion, and their total revenue is $138.36 billion, accounting for 59.1% of the top 50 enterprises’ operating revenue.

In FY2018, CIIC grew rapidly with a 21.8% operating revenue growth rate, surpassing the world’s largest payroll and benefits outsourcing service provider ADP, with a revenue of $13.71 billion, ranking fifth on the list. On the list of HRoot Global 50 Human Resource Service Providers 2019, human resource service providers from China also include 51job and Strait Human Resources. Online recruitment service provider 51job has grown rapidly, ranking third in the list of revenue growth rate with 34.0% , the overall ranking has risen three places from last year.

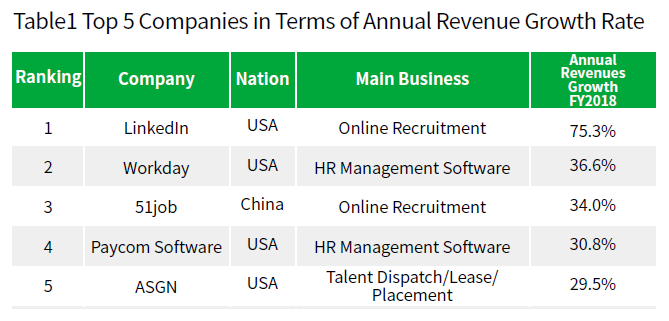

As for the ranking of revenue growth rate, the top 5 companies are mainly concentrated in online recruitment and human resource management software segmentation industry. LinkedIn, the world’s largest professional social networking site, ranked first with 75.3%. One year after LinkedIn was acquired by Microsoft, its personal data began to integrate with Microsoft Office 365 and other businesses, which created a more modern work platform, changed the way of talent management, training, sales and marketing, and promoted the growth of revenue.

Compared with the data of FY2017, there are 5 enterprises whose revenue drops considerably, and belongs to the negative growth. Among them, companies whose operating revenue reduces more than $100 million include Volt and Work Service. SA. Volt has seen a decline in revenue for two consecutive years, because of the decreasing demand in the North American talent staffing market, as well as the sale of Quality Assurance Services and Maintech.

In terms of the operating profit, there are 38 enterprises have achieved profitability in HRoot Global 50 Human Resource Service Providers 2019, 4 fewer than last year. Organizations with more operating losses include Workday, Gattaca, and Volt.

Human Resource Service Industry Segmentation

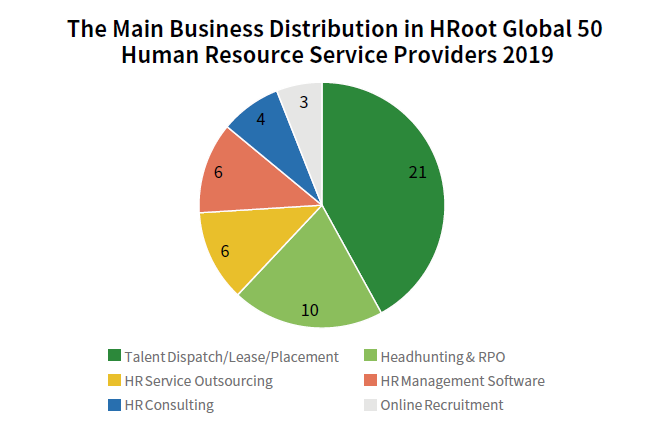

HRoot Global 50 Human Resource Service Providers 2019 involves six main businesses/segments, including talent dispatch/lease/placement service, headhunting and recruitment process outsourcing, human resource service outsourcing, human resource management software, human resource consulting and online recruitment. Among them, there are 21 companies focusing on talent dispatch/lease/placement services, followed by 10 providers of headhunting and recruitment process outsourcing, the numbers of human resource consulting and online recruitment are both fewer than 5.

In terms of revenue of different industries, the revenue of the talent dispatch/lease/placement service agencies is $144.29 billion, accounting for 61.6% of the total revenue. Human resource service outsourcing agencies ranks second with the revenue of $41.72 billion. The revenue of human resource management software and online recruitment industry is relatively low, less than 3%.

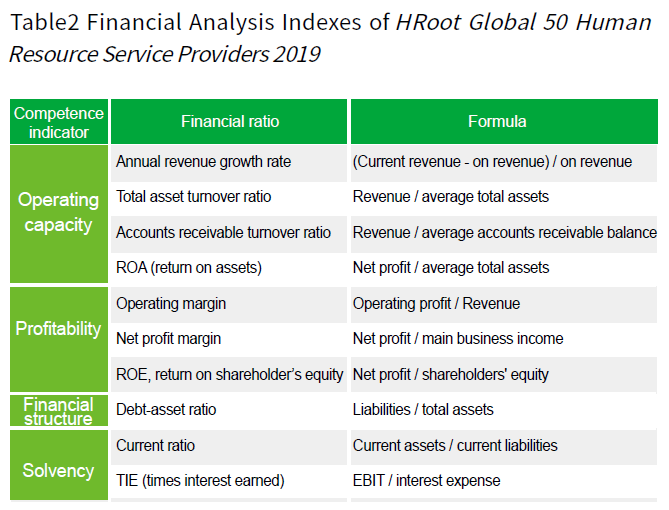

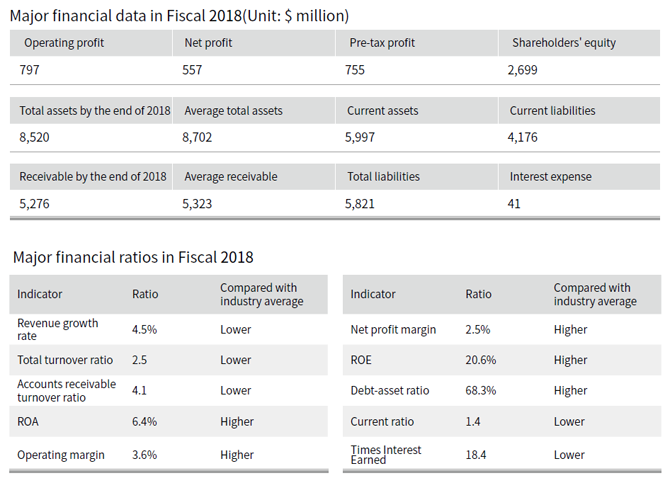

According to the concept of DonPont Analysis, several ratios used to rate the corporate operation efficiency and financial status are organically combined according to their internal correlations to form a complex index system. In this white paper, ten indexes of four dimensions are compared to deeply examine the operation status of various human resource service institutions.

According to the financial ratio list, the total asset turnover ratio and accounts receivable turnover ratio of Strait Human Resources are relatively high, which shows a stronger operational capabilities; Paychex, ADP, Paycom Software, 51job, Insperity, and Robert Half are more profitable; institutions such as Meitec Group, Brunel International, and Adcorp have the strong short-term solvency, while TeamLease Services, Harvey Nash, Kelly Services have the strong long-term solvency.

In HRoot Global 50 Human Resource Service Providers 2019, the concept of industrial average value has been introduced as the baseline providing benchmark for different industries in human resource services. In this white paper, the industrial average value refer to various average financial ratios of the 50 HR service enterprises in terms of talent dispatch/lease/placement, headhunting & RPO, HR service outsourcing, HR management software, HR consulting, and online recruitment.

According to the industrial average, online recruitment and human resource management software have higher growth rates of operating revenue, which are 43.49% and 20.15%. The total asset turnover ratio of talent dispatch/lease/placement services is 3.24, which is relatively high, and the benefits of asset investment are better. The net profit margin of headhunting & RPO is higher. The return on shareholder’s equity of human resource service outsourcing is much higher than that of other sub-sectors.

Talent dispatch/lease/placement service: Accelerate digital transformation

Technology is redefining the boundaries of the human resource service industry, and the global digital trend is changing the way the world works. For example, employers need to manage their workforce flexibly, and employees have the flexibility to manage their careers. The new employment model brings new growth opportunities. Many human resource service providers are actively transforming, innovating human resource service solutions, consolidating and expanding service products, improving client and candidate service experience, reducing service costs and improving capital efficiency, in order to adapt to the rapidly changing labor market needs of the new digital age.

The change from automation to the ongoing skills shortage and from the global economy to the legislation are affecting staffing firms. Staffing Industry Analysts predicts the increasing convergence between the staffing industry and new online staffing platforms and expects that this will continue to be a key trend in 2019. As the online staffing marketplace continues to grow faster than the traditional staffing market, it is expected that many more staffing firms will take advantage of the lower-cost business model offered by online alternatives, especially when many of their own temporary workers are getting additional income by complementing their temporary assignments with freelance gigs.

Headhunting & RPO: Extension&Development

In HRoot Global 50 Human Resource Service Providers 2019, there are 10 headhunting services and recruitment process outsourcing providers. The industrial annual average operating margin in FY2018 is 6.57%. Among them, Meitec Group and Korn Ferry have higher operating margins of 12.2% and 11.2% respectively.

The headhunting market is a fiercely competitive Red Sea market. Faced with the challenges of high cost of talent acquisition and talent pool, and the threat of alternative recruitment channels, the industry is actively seeking new profit growth points and business models. In recent years, global headhunting organizations have diversified their business through mergers and acquisitions, investment or transformation and restructuring. They actively extended to subdivided areas such as talent consulting, talent outsourcing, and talent dispatch to create more value for customers.

With the increasing complexity of the global economic, social and political environment, and the accelerated development of emerging technologies such as artificial intelligence, automation technology, and cloud computing, enterprises are facing the challenges of transformation and reshaping, which has an important impact on the demand for the human resource service market. The capital will strongly promote the development and reshuffle of the industry. In a rapidly changing market environment, some institutions may sell part of their business in order to focus on strategic main channels, and accelerate investment in core growth areas. Others constantly expand the business scope, extend their service among the upstream and the downstream, and enhance their self-advantages by the diversification of the complementary business in terms of the financial structure and the anti-risk ability. The sale, mergers and acquisitions and business restructuring of enterprises have to be based on the market demand, as well as their own strategic positioning so that enterprises could grasp the opportunities and respond flexibly in the new competition, and create greater value for customers.

Human resource service outsourcing: Vertical subdivision and specialization

In order to reduce the labor cost and employment risk, and to maximize the efficiency, the enterprise entrusts all or part of the human resource management affairs to the professional human resource service organization. According to the specific service content, human resource service outsourcing includes human resource management outsourcing, salary and welfare outsourcing, social security outsourcing, and individual tax payment, etc. With the transformation and development of enterprise organizations, enterprises will outsource more and more routine work to better focus on their core business.

The payroll and welfare service is the business with the highest frequency, the largest number of people, and the most concerned about the human resource management work. The United States has a well-recognized social security and taxation system. Human resource workers often need to spend a lot of time and energy on various reports. Therefore, many companies will outsource payroll, social security and taxation services to third-party professional human resource service providers. Of the six human resource service outsourcing providers that entered the list, four providers were from the United States.

With the slowdown in economic growth, the official positions of enterprises are shrinking and the number of outsourcing jobs may be more and more. In addition to the outsourcing of traditional general jobs, a large number of technical jobs derived from emerging businesses, including artificial intelligence, cloud computing and other related types of work, have become an important part of the human resource outsourcing industry. With the improvement of the specialization of human resource outsourcing services, the target of human resource outsourcing services will begin to differentiate, and the requirements of various organizations for their services will be more personalized and customized. In the future, the professional division of labor of human resource service outsourcing organizations will be refined and improved, and more focused on providing customers with targeted and differentiated products and services to meet the service needs of different enterprises.

Human resource management software: Opportunity & challenge

The ever-changing talent management system is both an opportunity and a challenge. On the one hand, in order to improve the internal agility of the organization and reduce the management cost, the demand for purchasing external human resource software services will continue to grow. Cloud computing services such as SaaS will gradually complete the penetration of the entire life cycle of internal employees. According to the prediction of International Data Corporation (IDC), global investment in public clouds will reach $140 billion by 2019. With the continuous maturity of IaaS (Infrastructure as a Service) and the promotion of cloud deployment, the demand for SaaS will further increase. If human resource management software suppliers want to survive in a fierce market competition and new management environment, continuous R&D investment and customer relationship training are unavoidable issues.

In addition to the need for competitive advantage, the R&D investment also partly reflects the transformation of the human resource management software in terms of positioning. From the software that solves the single personnel problem, it has gradually developed into a talent management system covering multiple nodes of the employee life cycle, and then it has become a platform for connecting people inside and outside the organization. Through the access of the platform, enterprise managers could understand the situation of employees and obtain corresponding human resource management solutions in a timely manner. Corporate employees can also understand business processes through personal terminals, participate in team management, and improve their performance. With the continuous innovation of the technology and the application of human resource management software, the market demand and deep potential of the entire industry will be further explored.

Although the human resource management software industry as a whole shows a strong vitality, rapid development of the digital technology, increasingly younger labor teams made up of teammates of all age groups, continuous performance management and organizational design with teams at the core have fundamentally changed how the organizational work gets done and raised requirements of characteristics of new human resource software tools and platforms. Meanwhile, the industrial barriers still exist. In addition, competitors outside the human resource service industry are also extending to the human resource service industry, which means the industrial boundary of competition is expanding.

Human resource consulting: Fusion development

The trend of commercial brokerage companies and headhunting companies tending to merge business with human resources consulting companies has already appeared. Human resources consulting companies have been frequently acquired by financial, insurance brokers and headhunting companies. For example, Hewitt was acquired by insurance broker Aon, Tower Watson was acquired by insurance broker Willis, and Hay Group was acquired by Korn Ferry, a company which is transforming from a headhunting company to a management consulting firm.

In the process of actively adjusting and restructuring the business portfolio, human resource service providers are integrated and gradually focus on their respective key service areas. Not like the recruitment and remuneration research, which are recurring businesses that need to be generated frequently. The consulting business needs to be combined with a long-term fixed income-generating business in the future.

Online recruitment: Create the human resource ecology

Online recruitment is a service that connects people and job through the Internet and matches the needs of employers and candidates. The basic requirement of online recruitment service is efficient, accurate, simple and time-saving. Based on the development of new technologies such as big data, cloud computing, and artificial intelligence, etc., more and more online recruitment agencies provide users with refined and personalized solutions, improve the precise matching between job seekers and hirers, meet the diversified needs of users, and improve user experience.

The traditional online recruitment business model mainly aims to generate information pool by attracting enough employers posting jobs and job seekers posting their CVs, and advertising charges are the main source of income. Gradually there are many problems such as large amount of information and redundancy, lack of matching information and high time cost. As individualized needs and recruitment requirements for different scenarios increase, online recruitment agencies are facing transformation and service upgrades by using advanced resume search tools, simplifying search, reviewing candidates, quickly discovering and comparing candidates, accurately matching potential candidates needed and improving efficiency.

Online recruitment service organizations use new technologies, continuously innovate and transform, extend service scope, and lay out human resource service ecosystem. It is a trend to provide one-stop service for human resources at all stages of job seekers’ career. For online recruitment providers, in addition to continuously improving technical capabilities, through technical means to improve the efficiency of matching, it is also necessary to integrate the resources of the platform itself, extend the value chain of talent services, and create greater value.

Industry Reshuffle and Rising Stars

In the HRoot Global 50 Human Resource Service Providers 2019, four organizations have entered the list for the first time, three of them are mainly engaged in talent dispatch/lease/placement.

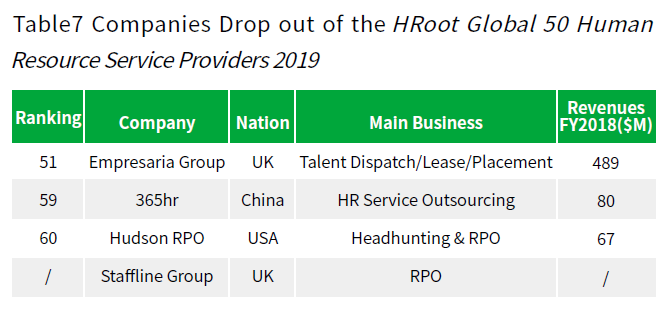

Four companies fell out of the list. Empresaria Group’s revenue is still growing at a rate of 6.4%, but due to the strength of the new entry companies, it is regrettable to be off the list. In the three fiscal years of 2015-2017, the revenue generated by 365hr for labor dispatch and labor agency business shall be confirmed according to the total amount paid by employers. In FY2018, in accordance with the detailed provisions of the Accounting Standards for Business Enterprises No. 14 – Revenue issued by the Ministry of Finance, in the labor dispatch and labor agency business, the human resource service institution is only acting as an agent and the revenue should be recognized on a net basis. The agent’s salary, social insurance, and housing fund subtracted from the total cost of the employer is net income. Due to the different accounting statistics method, 365hr’s revenue dropped sharply in FY2018. If all the revenues were re-stated according to the adjustment, the revenue increased by 39.4%. Hudson RPO completed three independent transactions in FY2018, sold all of its agency recruitment and talent management operations in Europe and Asia Pacific, completed the strategic adjustment process launched several years ago, focused on its core recruitment process outsourcing business, and changed its operating brand name from Hudson to Hudson RPO.

In the sub-list of the HRoot Global 50 Human Resource Service Providers 2019, the two institutions with higher revenue growth rates are Career International (97.5%) and LiePin (51.7%), both come from China. The two Chinese human resource service organizations, which look like rising stars, are expected to enter the top 50 list in the future.

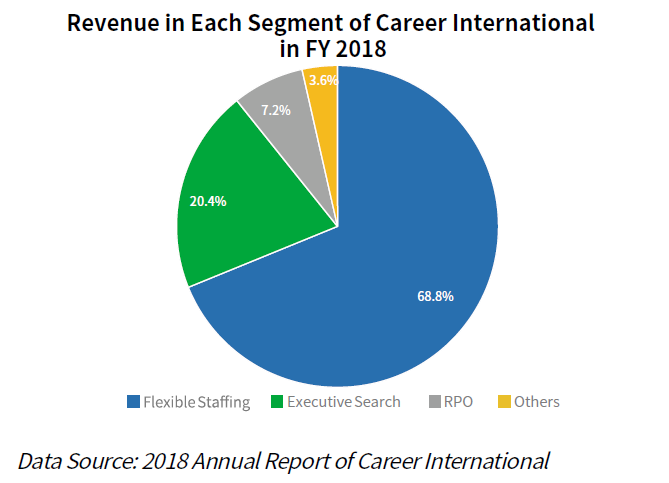

Career International is the first human resource service company to land in A-shares in China. It has nearly 100 branches and more than 2,200 professional recruitment consultants in China, India, Singapore, Malaysia, the United States, and the United Kingdom. Through continuous development of technology and upgrading of AI machine learning, Career International has increased its empowerment to executive search, recruitment process outsourcing, and flexible staffing, shortening work hours in all aspects, from getting customers to candidates screening, and from interviewing to sending candidate reports. In FY2018, the company had successfully recruited more than 25,200 middle and senior managers and professional technicians through executive search and recruitment process outsourcing business, and sent more than 108,000 people through the flexible staffing business.

In terms of the proportion of revenue the three major businesses, Career International’s flexible staffing accounted for 68.8%, and executive search accounted for 20.4%. From the perspective of revenue growth, the revenue of RPO increased rapidly by 130.4% over the same period of the last year. In addition to the three main businesses, Career International also focuses on the human resource industry chain in the human resource planning, talent assessment, talent training and development, human resource consulting, employment, the talent-oriented resume coaching, career planning and other aspects.It exerts efforts to provide more comprehensive and diversified services for enterprises and talents, and gradually form an ecological model of closed-loop services for the entire life cycle of enterprises and talents.

Based on its own product system and the ever-changing market demand at home and abroad, Career International not only upgrades its business model, but also relies on brand/network layout, product/service rapid response, management vertical segmentation, talent echelon training, group systemization/standardization management, overseas expansion/investment mergers and acquisitions. The six factors work together to drive performance growth and enhance the competitive advantage in the industry.

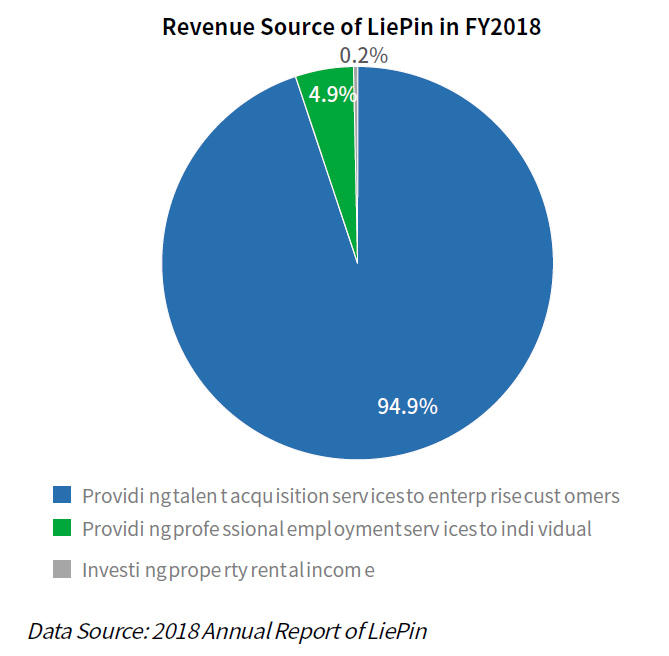

LiePin issued its first full-year earnings report after its listing. 94.9% of its revenue was from corporate customers, mainly including customized subscription packages and transaction-based talent acquisition services for them, an increase of 46.1% over the same period of FY2017. 4.9% of the revenue was from individual paid users, including personal professional services such as senior membership services, career counseling and resume consultation, which surged 122.2% than FY2017. Focusing on deepening the personal user service, LiePin said that it will use its platform advantage to extend the service value chain, fully optimize and enhance the personal user experience, and help users achieve a better career.

LiePin has always been devoted to using technology to drive innovation and development,R&D investment accounted for 11.3% of revenue in FY2018. In 2018, the company carried out many innovations and upgrades, such as optimizing the interview, launching a new version of the job entry, creating a direct recruitment service, upgrading the workplace credit system, etc. The technological innovation has greatly improved the efficiency of matching, and users have obtained better professional services.

With the adjustment of China’s economy and industrial structure and the increasing demand for medium and high-end talents at the enterprise and individual level, as a leading online recruitment service platform for the domestic headhunting industry, LiePin cooperates with headhunting and other ecosystem partners to create customized, closed-loop talent acquisition services, which are expected to continue to grow.

M&A New Tide: Professional Talent Tendency

M&A, as an important part of a corporate development strategy, is not only an internal requirement for enterprises to improve operational efficiency or scale effect, but also one of effective means for enterprises to cope with external changes. Through reasonable M&A activities, enterprises can improve and rationalize the order of market supply and demand, realize the re-allocation of economic resource, and thus obtain maximum profits.

The global M&A market is still active in 2018 and the domestic M&A activity is not significantly different from 2017. According to 2019 Global M&A Outlook published by J.P. Morgan, Global M&A market volume reached $4.1 trillion in 2018 and China continues to be active in the global M&A market. However, it appears that there is a trend of specialization under the sub-sector in the field of global M&A market. As Staffing Industry Analysts’ Staffing Mergers & Acquisitions: 2019 Update shows, staffing merger and acquisition activity accelerated in 2018 and organizations within professional staffing segments were more frequently targeted. The M&A activity among companies which specialize in professional increased by 18% compared with the same period in 2017. In terms of professional staffing segments, healthcare and IT staffing institutes comprised 24% and 15% of deal volumes, respectively.

In China, with the change of social economy and labor structure, labor costs are no longer the decisive factor of driving the development of enterprises. As a result, the demand of the job which mainly requires repetitive skills decrease gradually. The innovative ability has become the key to the occupation of the market. As the demand for professional talents with innovative capabilities is growing rapidly, the focus of corporate mergers and acquisitions gradually shifted from expanding production scale and lowering production costs to acquiring new technologies and expanding service systems. According to Bain’s M&A in Disruption: 2018 in Review, the number of “Range Transaction”( the transaction helps acquirers acquire new capabilities or new products) exceeded the number of “Scale Transaction”(the transaction helps the acquirer expand its scale or reduce the cost) for the first time in 2018. Among the transactions which are higher than $1 billion, “Range Transaction” account for 51%, which is one of the major changes in the M&A market over the past decade.

Among the 50 human resource service providers listed on HRoot Global 50 Human Resource Service Providers 2019, The Adecco Group Japan announced that it has acquired all the shares in Tokyo-based A-STAR. Furthermore, Kelly Services announced two acquisitions in the telecommunication industry including Global Technology Associates, LLC (GTA) and NextGen Global Resources, LLC (NextGen), which may represent forward-looking investments in a relatively new specialty market.

New technologies such as big data, algorithms, and artificial intelligence are driving intelligent changes in society as a whole. The human resource management system is expected to be optimized and upgraded and transformed by these new technologies. In the era of digital economy, human resource service providers are accelerating digital transformation, focusing on user experience and management efficiency in order to strengthen the core competitiveness and expand the competitive advantage. Human resource service providers will continuously extend and integrate its own service industry chain. As a result, the human resource service chain will cover the entire life cycle of users and take advantage of synergy to improve the anti-risk ability to under the overall economic downturn. In the future, there will be more cross-border activities, extension and integration in the human resource service industry, and the market will be more active.

......

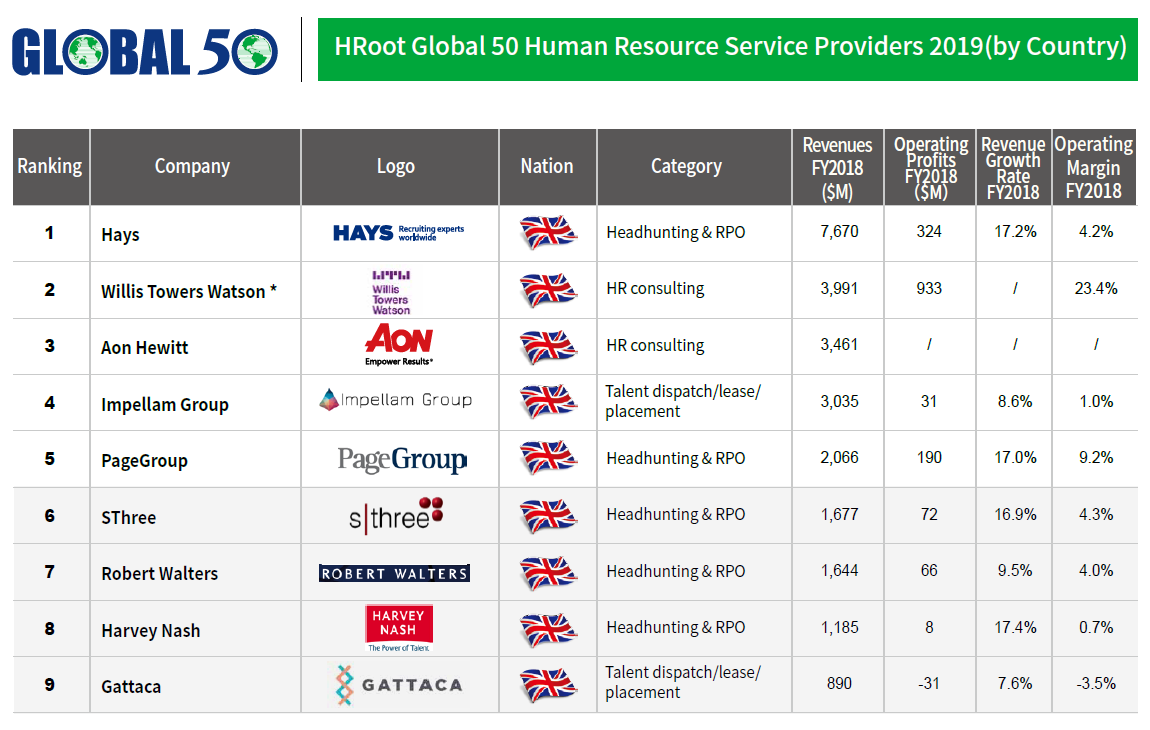

In this report, there are 6 sub-rankings: HRoot Global 50 Human Resource Service Providers 2019(by Country)、HRoot Global 50 Human Resource Service Providers 2019(by Category)、HRoot Global 50 Human Resource Service Providers 2019(by Annual Revenue Growth Rate)、HRoot Global 50 Human Resource Service Providers 2019(by Operating Margin)、HRoot Global 50 Human Resource Service Providers 2019(by Per Capital Income)、HRoot Global 50 Human Resource Service Providers 2019(by Per Capital Operating Profit). According to the 6 main business categories, compare the 10 financial ratios in their respective fields. In addition, there are major financial data and financial ratio tables in Fiscal 2018 for 50 companies.

ManpowerGroup’s major financial data and financial ratios in Fiscal 2018

This is a short version of the report. To read the full report, click on the download report。